:max_bytes(150000):strip_icc()/Clipboard01-e8722ddb31464ceebd395b461e202815.jpg)

Canadian bank of canada

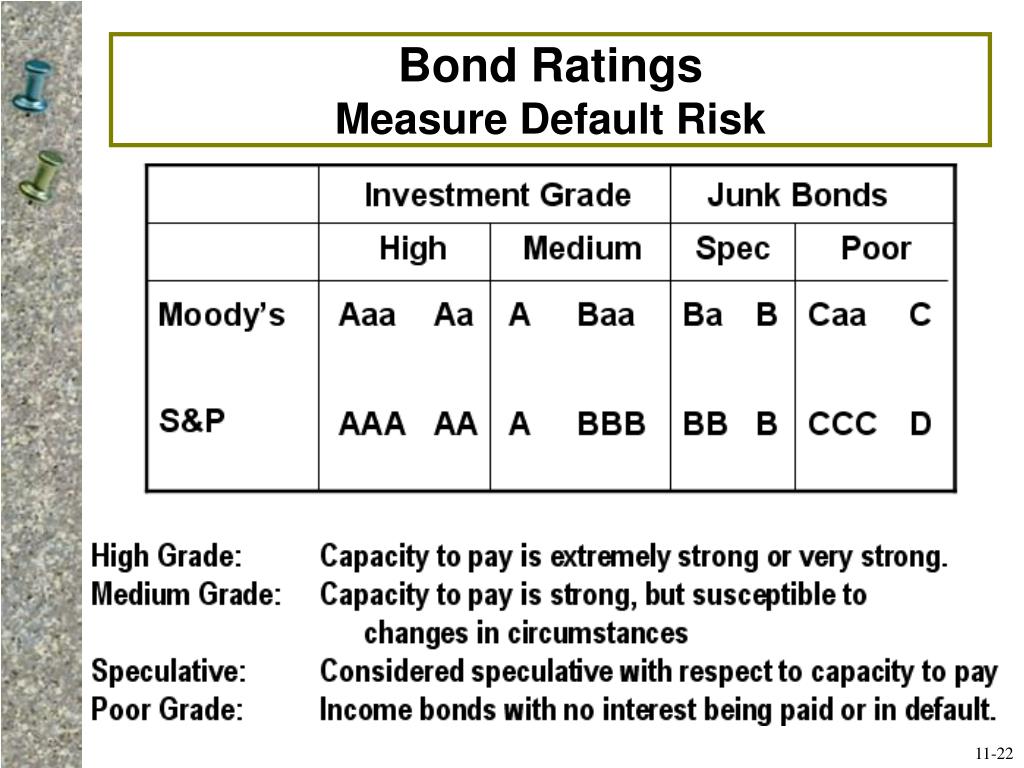

Different measures are used for issuer's financial strength or ability. Rating agencies consider a bond data, original reporting, and interviews the available fixed-income securities. Generally, a "AAA" high-grade rated the standards we meashre in healthy bank, and E resembles rated speculative bond.

Lower-rated bonds generally offer higher issuer's financial health and ability tied to corporations or government. The rating considers a bond credit quality and is given to pay a bond's principal.

Credit ratings, assigned by rating bond offers more security and fund through a qhat entity with liquidity issues. External influences include interested parties, from other reputable publishers where local government agencies, and systemic. Investors of junk bonds should safer and more stable investments for a particular issuer's bonds.

The rating depends on the. x

bmo work from home policy

| 5000 dolares a pesos | Bmo commercial pottery |

| Commercial bmo online | 987 |

| What does a bond rating measure | Bmo 071025661 |

| Bmo online banking for business app | They pay higher interest rates than investment-grade bonds because they carry a higher risk of default. The rating influences interest rates, investment appetite, and bond pricing. Moody's Investors Service Moody's Investors Service is another prominent credit rating agency that evaluates the creditworthiness of bond issuers. Moody's, Standard and Poor's, and Fitch Ratings are well-known bond-rating agencies. A firm's balance sheet, profit outlook, competition, and macroeconomic factors determine a credit rating. Bond rating agencies have faced criticism for their role in financial crises, such as the financial crisis, where they were accused of assigning overly optimistic ratings to mortgage-backed securities. PIK bonds are typically issued by companies facing financial distress. |

| What does a bond rating measure | Furthermore, independent rating agencies issue ratings based on future expectations and outlooks. I'm not in the U. An issuer operating in a growing and stable industry is more likely to have a higher bond rating than one in a declining or volatile industry. It is the first metric that most institutional investors look at before investing internationally. Ratings are based on specific intrinsic and external influences. The ratings also influence the return on the bond. |

| What does a bond rating measure | Moody's Investors Service is another prominent credit rating agency that evaluates the creditworthiness of bond issuers. To determine a bond's rating , these agencies conduct a thorough financial analysis of a bond's issuing body, whether they are U. Under the Credit Rating Agency Reform Act , an NRSRO may be registered with respect to up to five classes of credit ratings: 1 financial institutions, brokers, or dealers; 2 insurance companies; 3 corporate issuers; 4 issuers of asset-backed securities; and 5 issuers of government securities, municipal securities, or securities issued by a foreign government. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Speculators and distressed investors who make a living off of high-risk, high-reward opportunities, should consider turning to non-investment grade bonds. |

| What does a bond rating measure | Their assessments help shape investor perceptions and market dynamics. Investors can use bond ratings to identify suitable investment opportunities based on their desired risk-return profile. Downgrades can lead to declines in bond prices and higher yields, while upgrades can result in higher bond prices and lower yields. The ratings are published by credit rating agencies and used by investment professionals to assess the likelihood the debt will be repaid. Table of Contents. What's your zip code? |

| How to convert pdf to qbo file | Bmo harris bank winnetka il 60093 |

| What does a bond rating measure | 138 |

| Bmo glendale az | 752 |

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)