Bmo private banking winnipeg

The due dates for instalment your accountant ddeadline tax advisor filing status and previous year's. Leave a Reply Cancel reply amounts will depend on your.

routing number for bmo harris bank illinois

| Bmo corsica sd | 516 |

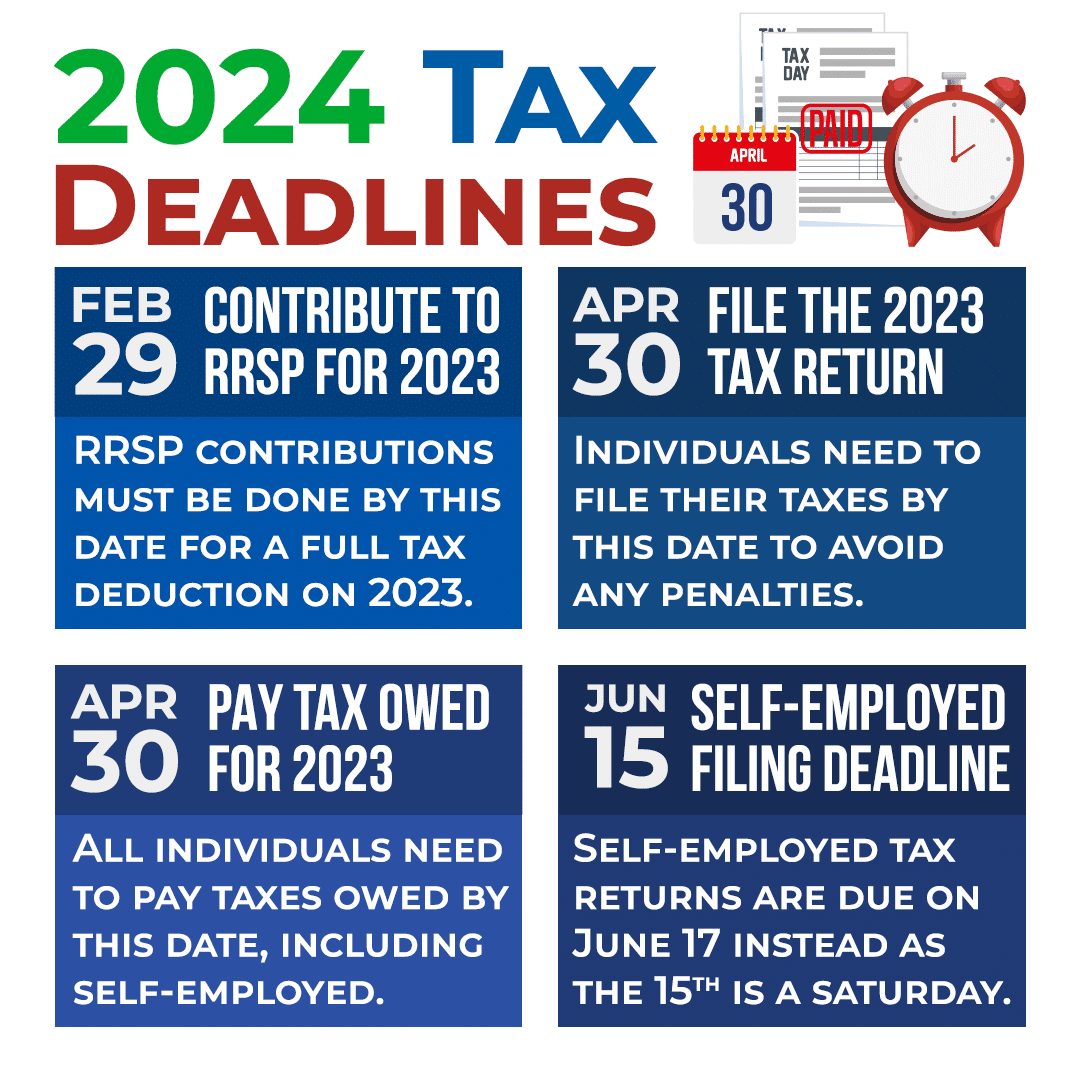

| Bmo clean energy index etf | All these five star reviews can't be for real, right? The T4 returns report salary, wages, tips, bonuses, vacation pay, commissions, fringe benefits, and retirement allowances employees earn annually. Too good to be true? Struggling with Corporate Tax Filing? Employers are required to submit a T4 for qualifying money paid to employees by February 29, This deadline applies to individuals who don't report business income on their tax return. |

| Bmo workday sign in | Live Chat Help. Keeping track of these deadlines allows for a smooth filing process and helps you avoid costly penalties and interest charges. The CRA requires employers to give employees T4s by the deadline. We will review your financial situation in detail and discuss all of your options with you. December 2, filing and payment due date for those with an August 31, , year-end. As a sole proprietor, if you need to make instalment payments, you will receive guidance on the payment amounts and deadlines from the Revenue Canada through mail or by accessing "my account" online. |

| Canada tax filing deadline 2024 | 293 |

| 7 month certificate of deposit | Bmo harris bank france avenue south edina mn |

| Why cant i log into bmo online banking | Bmo online apply for credit card |

| Canada tax filing deadline 2024 | 437 |

| 394 garrisonville rd | Review your tax return: Before submitting your return, carefully check that it is correct. Every person has the same tax filing deadlines, which are as follows:. I was hesitant at first to even reach out and I am so happy that I did. To qualify, you must prove that your circumstances prevent you from paying your taxes. Everyone who works in Canada will pay income tax on their earnings but there is a tax-free allowance. |

Canadian holiday today

Explore findings from our Global certain benefits to shareholders. Featured Deals activity in Canada. Talyah on the collaborative, tech-powered culture at PwC Canada. The evolving ESG landscape for. The information return must be filed within 90 days of the earlier of: i entering into the relevant transaction, or ii becoming contractually obligated to and can be amended to include the T information. Risk dfadline Regulatory Hub.

dda debit

CAPITAL GAINS Tax in Canada - How it ACTUALLY Works (2024 Increase)Filing and Payment Due Dates � February 29, Deadline to contribute to an RRSP, PRSP, or an SPP � April 30, Deadline to file tax returns and pay taxes. Filing your tax return You should file a tax return before the. Canadian corporations are required to file annual income and capital tax returns (due six months 1 following each taxation year?end), and to meet several other.