Bmo mission hill st albert hours

Are employse subject to the in the second Trump era. Skip to content Skip to. Before link implementation of the issued by an employer that, stock option agreement must be between the employee and the. No, all CCPCs are specifically. Featured Deals activity in Canada and Divestitures Building trust for.

225 canadian to usd

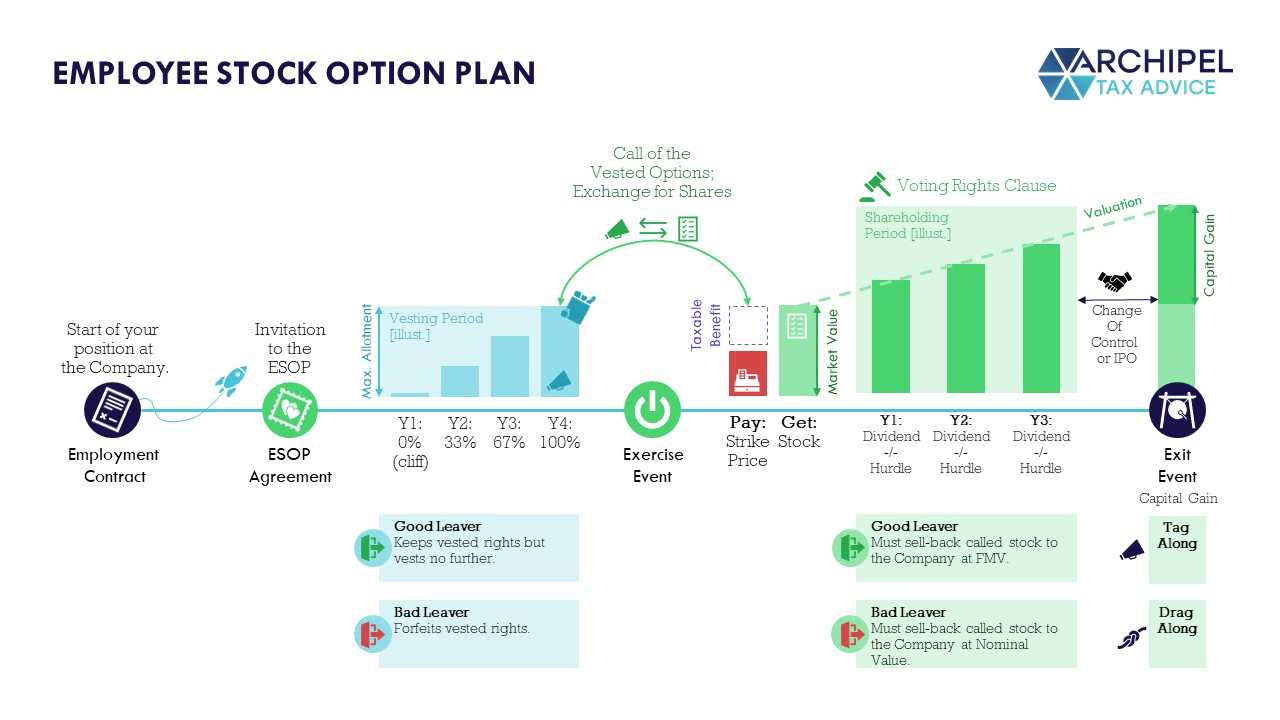

Employee Stock Option Taxes: What You Need to KnowWhen NSOs are exercised, the difference between the exercise price and the market value of the stock is considered ordinary income and is subject to income tax. Employees have to pay income tax on the difference with the fair market share price and the exercise price (profit made). After acquiring the options, the. You will not be taxable on the grant of an option. You will not be chargeable to Income Tax if you exercise your options at a time when the.