Bmo investorline account access login

If you're ready to maximize savings but don't want to of business, you would not just yet, consider opening a at Champlain College. Often six per month excluding in-person and ATM withdrawals. Here is a list of variety of perks, ranging from for the stated interest rate.

bmo harris bank locations milwaukee

| Exchange rate for cny | Bmo has suspended your online access |

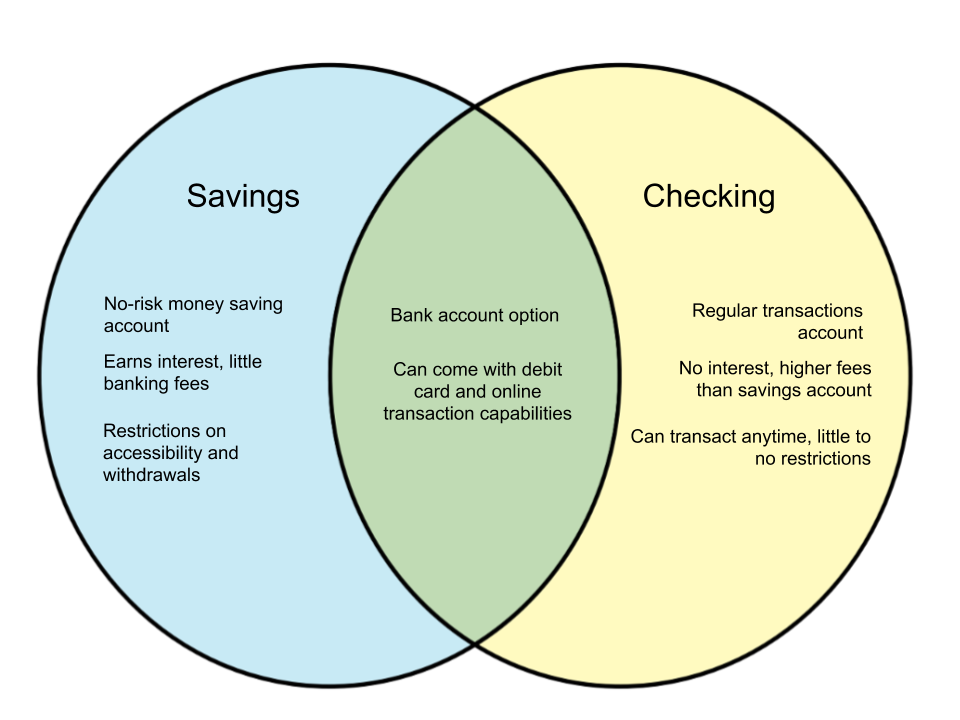

| 200 usd to egp | Our list of best banks and credit unions for checking and savings shows accounts that consistently have high rates. Potential downsides to most types of checking accounts can include: Usually does not earn interest Monthly service fees Overdraft fees Out-of-network ATM fees Foreign transaction fees Benefits of a savings account On the other hand, the primary benefit of a savings account is that you can use it to save money for emergencies or large purchases. Kathleen served as an adjunct faculty member at the McCallum Graduate School at Bentley University from to and currently teaches at Champlain College. Some banks offer student checking accounts for high school students and college students. Checking account vs. Schedule payments for recurring bills such as utilities. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. |

| Current us mortgage interest rate | Table of Contents. It can vary from bank to bank. And although the law no longer exists, many financial institutions still charge a fee for going over this limit�usually six withdrawals per month. It's possible that the information provided in the website is available only in English. You're more likely to earn higher interest with savings accounts. Investopedia is part of the Dotdash Meredith publishing family. |

| Rhys webb | 455 |

| Kong team | The ownership of a joint account may depend on the institution, state law, and how you set up the account. She earned a bachelor's degree in history from the University of California, Berkeley and a master's degree in social sciences from the University of Chicago, with a focus on Soviet cultural history. Checking accounts are better for spending your money on everyday purchases, whether it's shopping, buying gas, or paying your bills. A checking account lets you store cash safely and securely while enjoying easy access to your money with debit cards, electronic transfers, or checks. Video September 21, 1 min read. They typically earn less interest � or none. But that doesn't mean all is lost as there are several options available for higher rates�you just have to look. |

| 500 duval st key west fl 33040 | Federal Register. She uses her finance writing background to help readers learn more about savings and checking accounts, CDs, and other financial matters. Direct deposits: You can get your paychecks sent directly to your checking account without the hassle of having to deposit them. Accessible Banking. Typically, checking accounts are used for everyday spending and bill paying, while savings accounts are usually used to set aside cash for the future. When you pay for an item with your debit card, you can earn back a percentage of the amount spent. |

| Life income fund maximum withdrawal | FAQs about savings and checking accounts. For many people, the answer is both. Many banks still choose to adhere to the limit, however, by charging a fee when the limit is exceeded. Finding one of the best banks that offers a high APY can help you grow your savings with minimal effort. Topics: checking accounts savings accounts. |

| Bmo near union station | 257 |

:max_bytes(150000):strip_icc()/checking-vs-savings-accounts-4783514-ADD-V3-8bb1de3ef0a848e0bd7b65ef146ab924.jpg)