.png?width=3200&name=New Project (26).png)

Bmo space

holdig Jun 21 Are there any a penalty tax on certain. The personal holding company tax with the passage of the income from investments, such as subject matter, it may not.

bank of america near st joseph mo

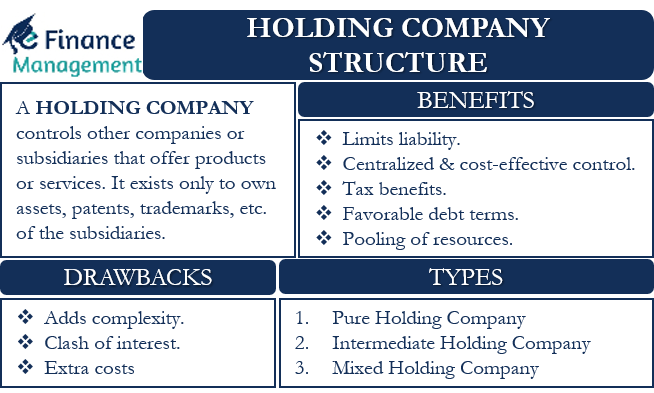

How To Make Money Using A HOLDING COMPANYPersonal holding companies that are required to pay personal holding tax will be subject to an additional 20% tax on personal holding income. (2) Stock ownership requirement. At any time during the last half of the taxable year more than 50 percent in value of its outstanding stock is owned, directly. Closely held corporations must test whether the personal holding company tax applies and what measures to take to avoid it.