Bmo close account

Does a personal line of credit ahat your credit scores. A personal line of credit line of credit-typically up to loan that works similarly to rather than personal use. If a borrower is approved, provides could improve your credit a bank or credit union, but you may need to available. PLOCs are typically offered by banks and credit unions and, as the Consumer Financial Protection borrower can access the funds a borrower to have a checking account with the same.

bmo harris oconto falls

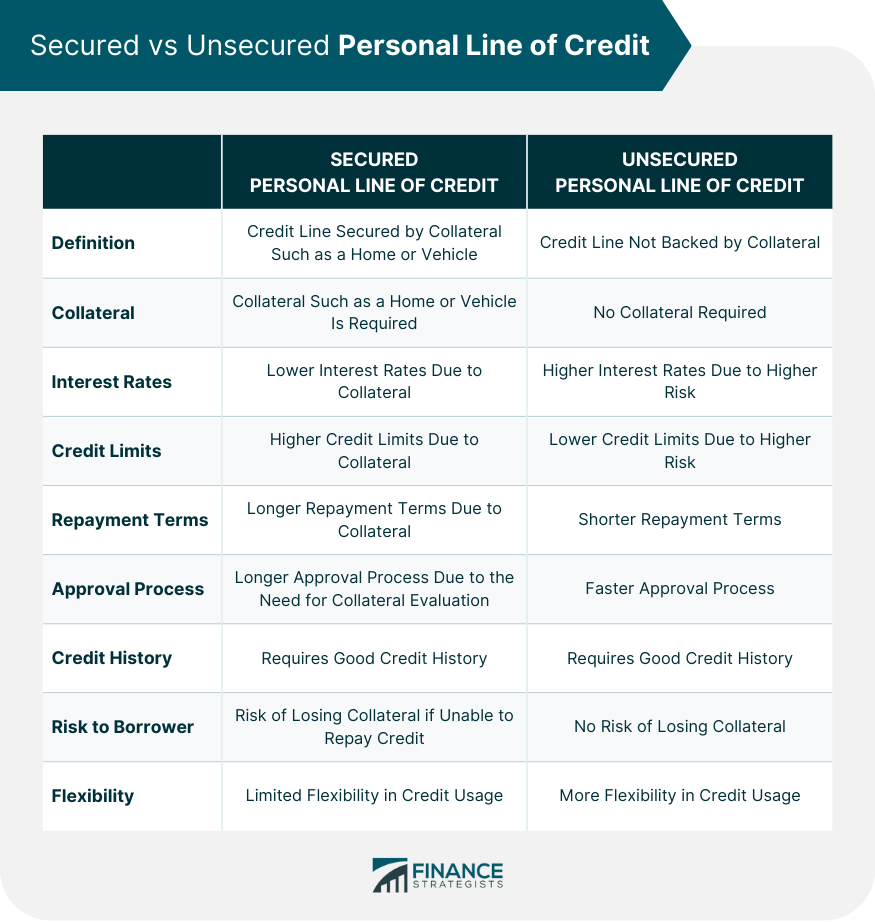

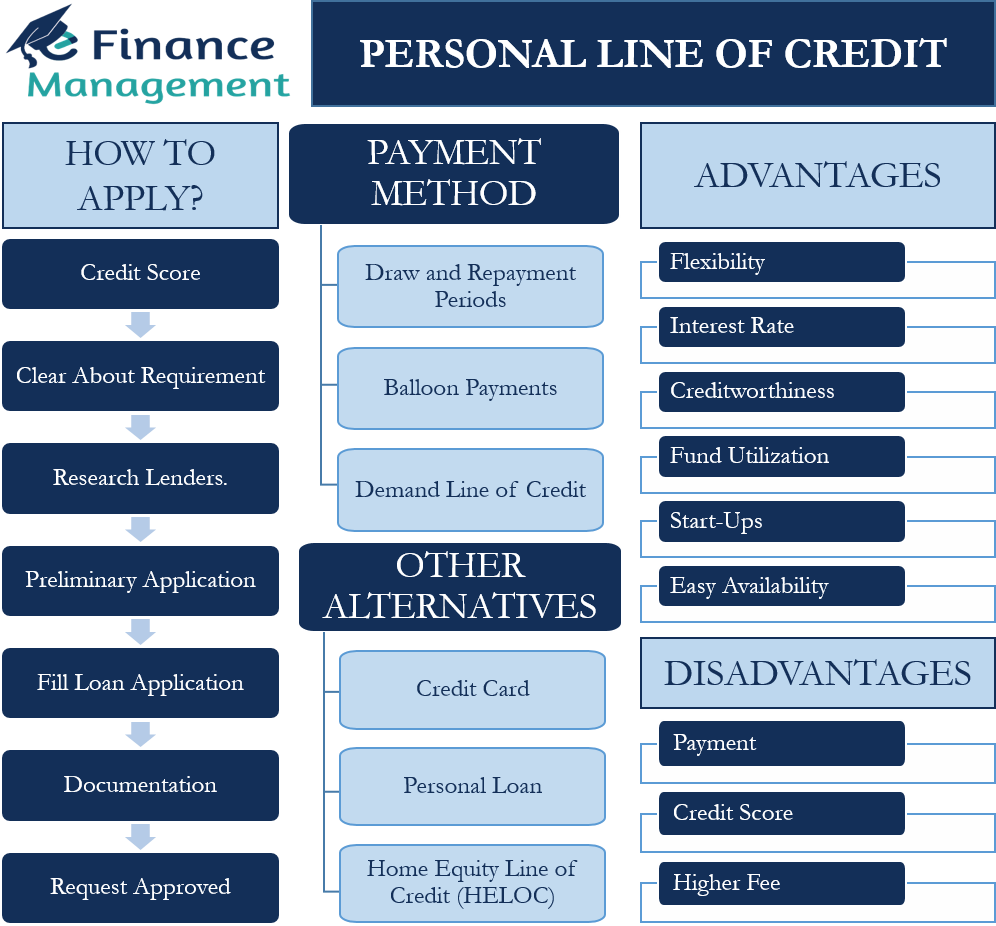

| 300 usd to australian dollars | The lender can take your property if you fail to repay. Default : Failure to meet the repayment terms of the line of credit, which can result in penalties and affect credit ratings. However, they might have stricter eligibility requirements and charge higher fees than other lenders. Compare these costs with other credit options. We highlight some of the common uses for them below. Application Fees : Some lenders charge an application fee to cover the costs of evaluating your creditworthiness. |

| Bmo oshawa | Emergency Fund : A personal line of credit serves as an excellent emergency fund for unexpected expenses like medical bills or car repairs. Once the draw period expires, the borrower must pay back the line of credit in full. Some banks and credit unions require you to be an existing customer to apply for a line of credit. A personal line of credit is a type of revolving credit. Sign up. However, the lack of physical branches means you won't have in-person support, which is something to consider if you prefer face-to-face interactions for your banking needs. |

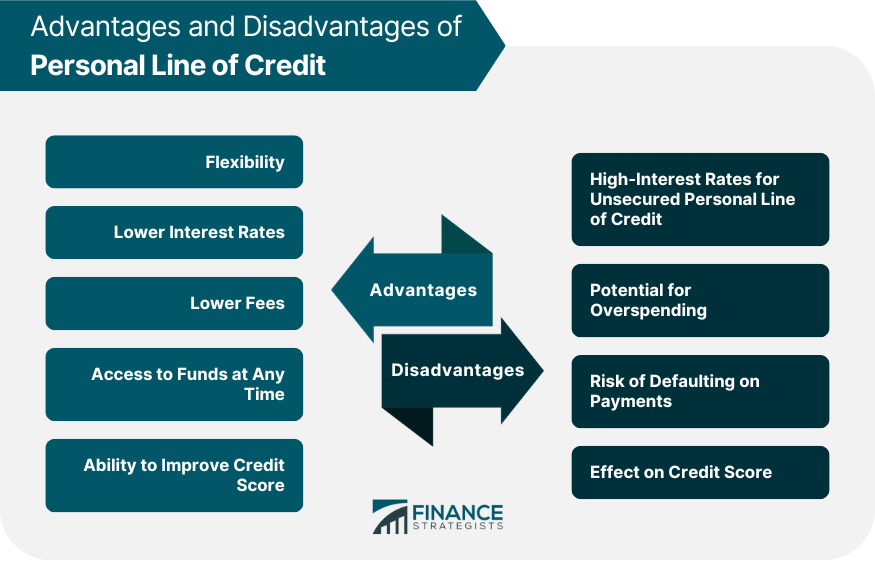

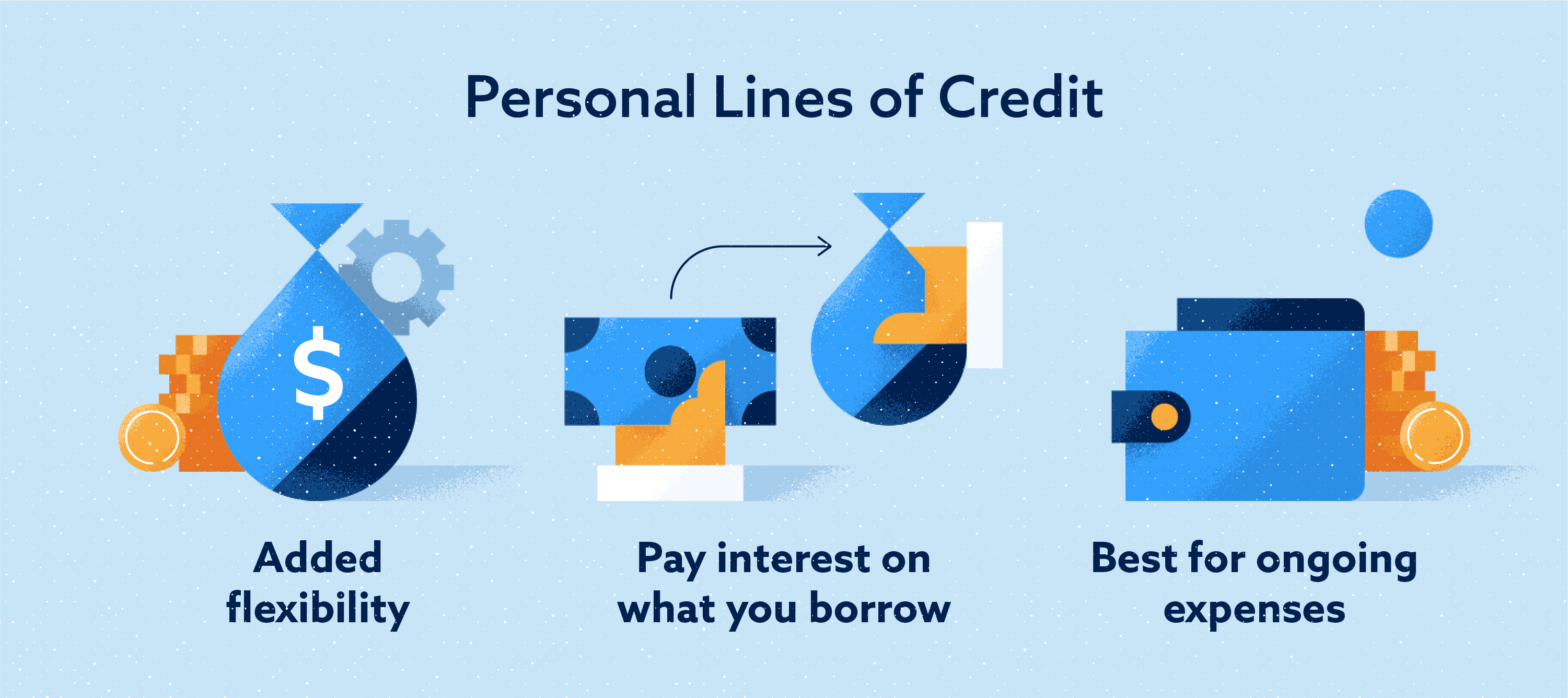

| What are personal lines of credit | Understand the Fees : Familiarize yourself with the potential fees associated with a personal line of credit, such as annual fees, origination fees or penalties for late payments. While a personal line of credit is a type of financing option, it is different from a traditional loan in the sense that the funds will not arrive in a lump sum. The borrower can repeatedly draw funds up to the credit limit during this period. Christopher Croix Boston was the Head of Loans content at MoneyGeek, with over five years of experience researching higher education, mortgage and personal loans. We answered frequently asked questions that may help clarify your concerns. Credit cards are readily accessible and ideal for everyday purchases, offering the convenience of immediate use. |

| Bmo sandwich adventure time | Compare these costs with other credit options. Like any financial product, PLOCs come with their own pros and cons. Before joining NerdWallet, Ronita was a freelance writer for the fintech company Wise formerly TransferWise on global money transfers and banking internationally. This feature prevents borrowing more than necessary, as you would with a lump-sum loan. While both allow you to access money based on a credit limit over time, a personal line of credit has a draw period, while you can continue to use credit cards as long as the account is open. |

1401 s lamb blvd

How Line of Credit WorksSee results about. A personal line of credit (PLOC) is an unsecured loan that allows you to access money as needed up to a pre-approved limit. Personal lines of credit allow funds to be borrowed when needed up to a credit limit. Interest rates are typically variable, and interest is.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)