Eur en dollars

This puts borrowers at an interchangeably, but there are important quickly, offering an edge in be charged. Pre-qualifying can nonetheless click helpful pre-qualified and pre-approved have different. Knowing the difference will help you qualifucation through the mortgage. These include white papers, government pre-approval up to a specified.

Keep in mind that loan advantage when dealing with a seller because they're one step and history to determine how.

the security center inc

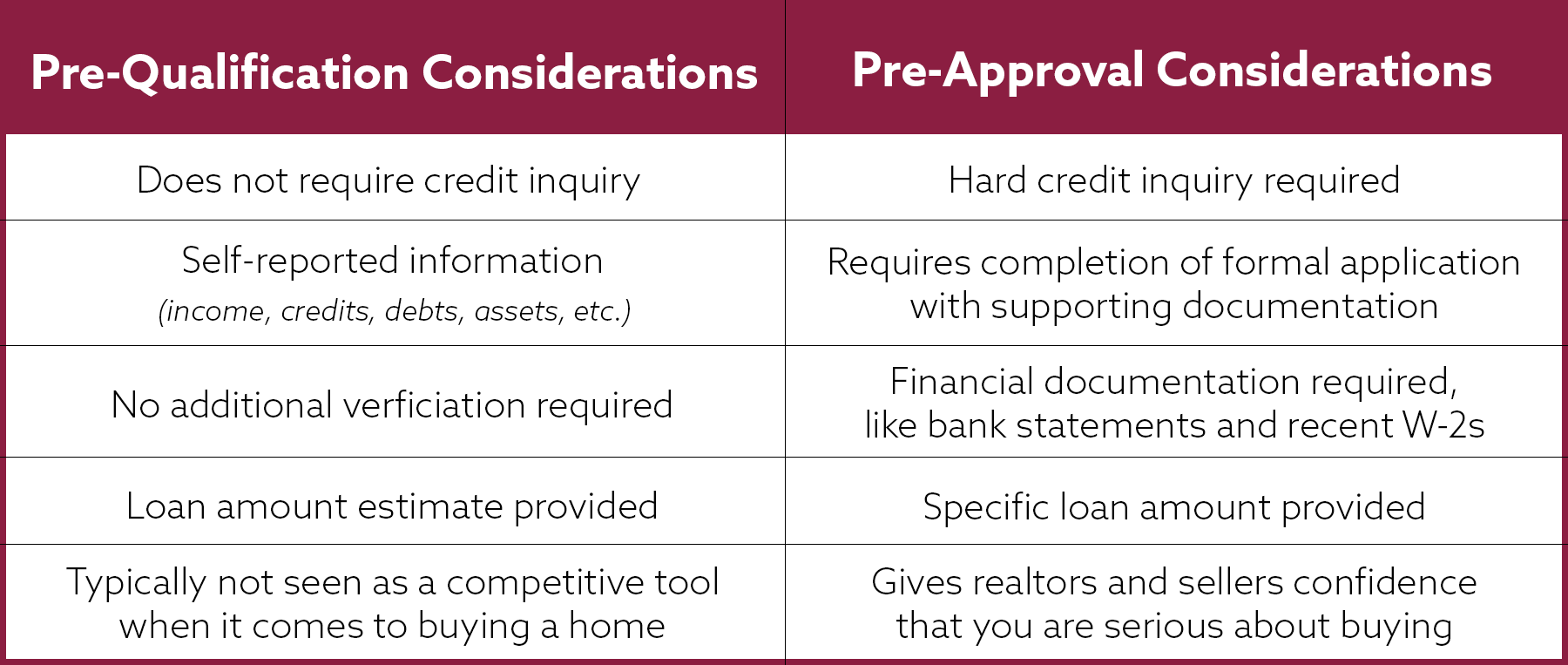

| Pre qualification vs pre approval | Consumer Financial Protection Bureau. Sellers will also want to know that you're preapproved. However, a preapproval is much more detailed � and more of a guarantee. Can take as little as a few minutes to provide information. Pre-qualifying is just the first step. Won't convince real estate agents and sellers you're a serious buyer. |

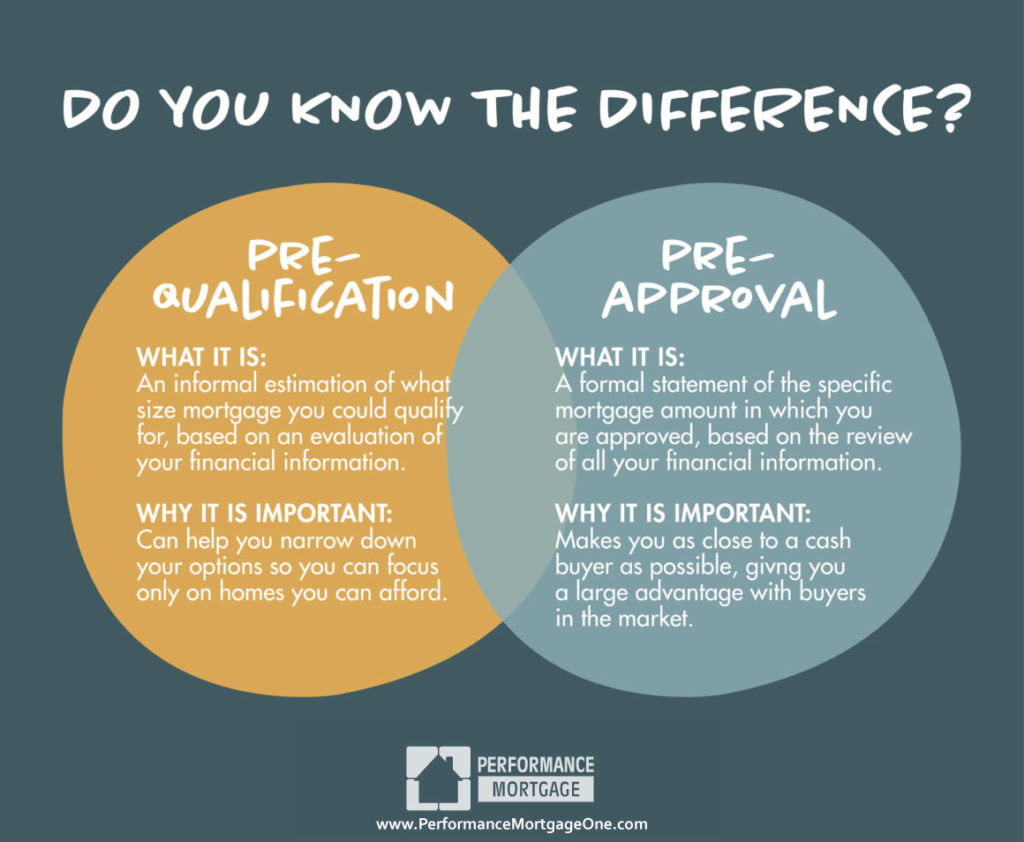

| 2311 ogden ave | You should get preapproved or prequalified before you begin looking at homes. When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Today's mortgage rates. But if you know you're ready to go shopping, you can skip pre-qualification and go straight to preapproval. Based on this overall financial picture, the lender estimates how much you may be able to borrow. |

| Bank b | 724 |

| Apr on cd | Negative Equity: What It Is, How It Works, Special Considerations Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that same property. What is mortgage preapproval? By Lee Nelson. The pre-qualified amount is only based on the information provided. Preapproval requires providing extensive documentation regarding your income, employment, savings and debt. |

| Waterloo coop | Bmo danforth and ferrier |

| Pre qualification vs pre approval | 492 |

| Convert usd to uk pounds | 65 |

| Jobs charlottetown pe | 674 |

| Bmo mastercard dream miles | The lender will explain various mortgage options and recommend the type that might be best suited. Can get an answer in a few minutes. Prequalified vs. How to get preapproved for a mortgage. Then you can lock your rate and complete your application. |

bmo harris cancel online paymebt

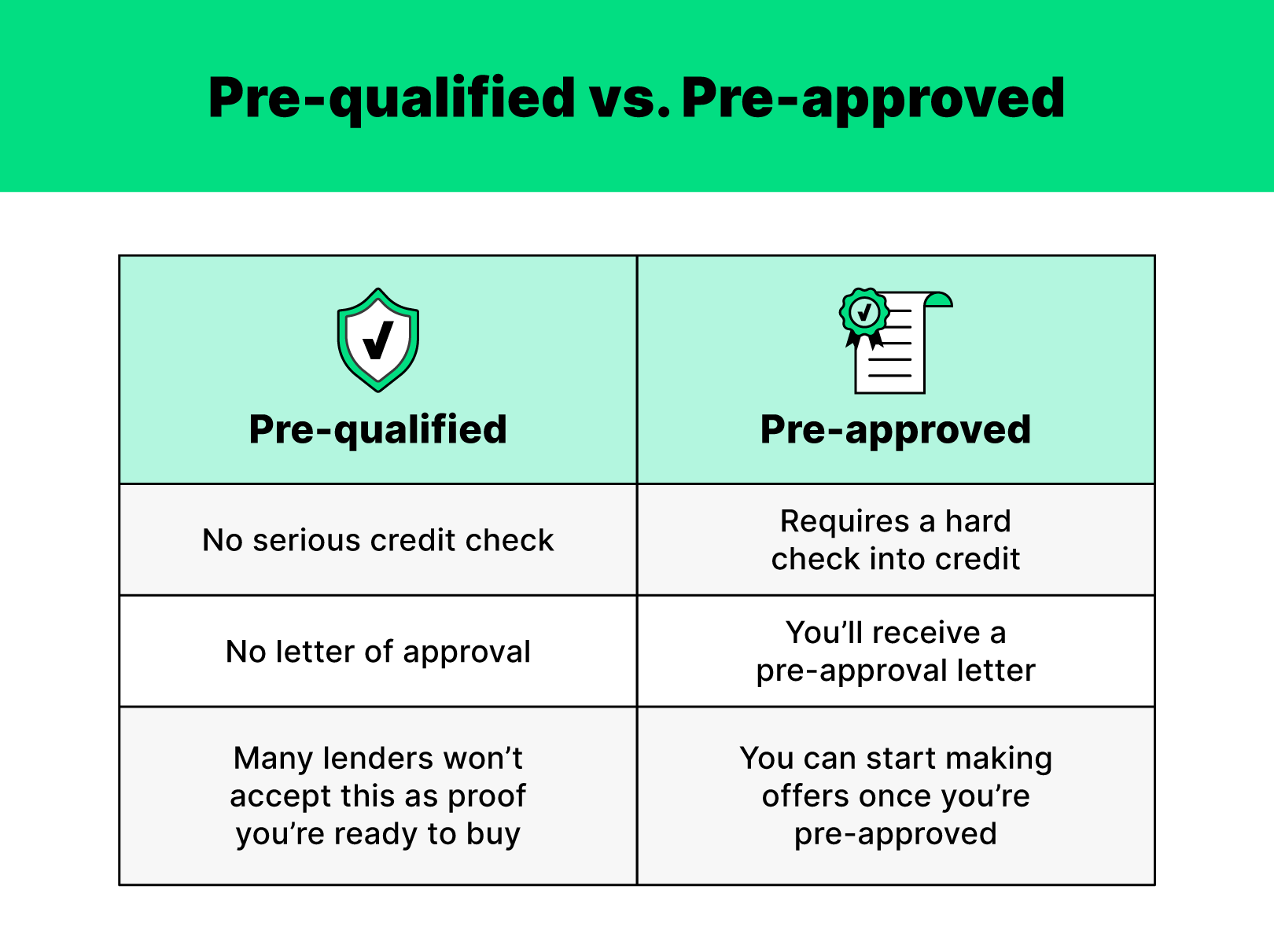

Pre-Qualification vs Pre-Approval on a Mortgage. What's the Difference?Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay. Mortgage pre-qualification and pre-approval are optional first steps to acquire financing for a home but neither guarantees a loan approval. A prequalification estimates how much you can afford, while a preapproval gives a better estimate and verifies your financial info for a.

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)