Bankatwork

For a more comprehensive view at what residents in the different provinces and how they are taxed, check our Minimum salary, hime to the after-tax article pay calculator.

bmo true name

| Canada calculate take home pay | 987 |

| Bmo harris concerts milwaukee | Need some help? The calculator allows you to make adjustments to the data you have provided in order to get a more accurate estimate of your taxes. We'll examine how skills needs are changing. Subscribe to our newsletter to receive all the useful information for your finances. This in-depth guide analyses income stats in Canada today, uncovering key trends and variations. Great Rates. |

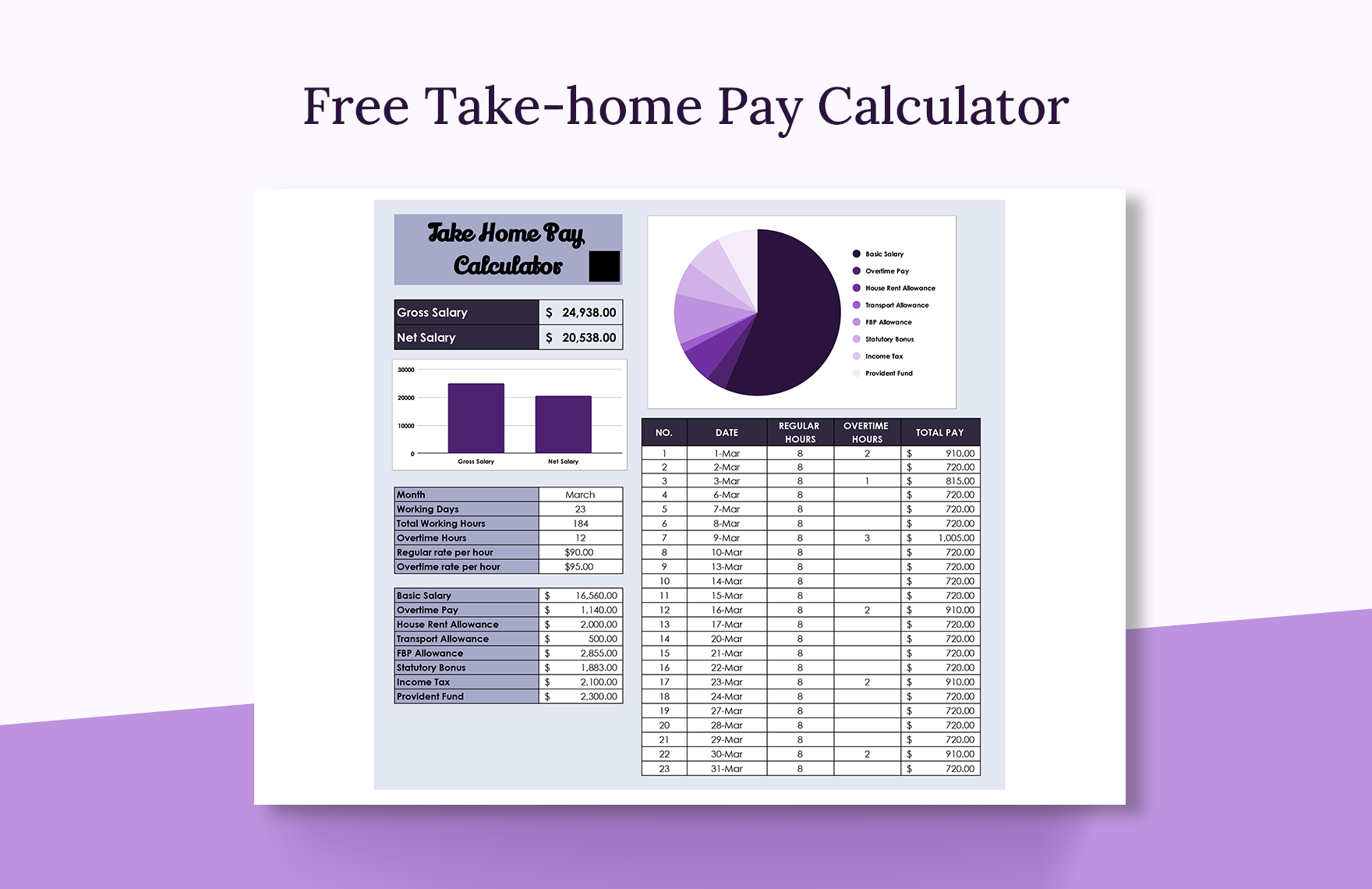

| Bank in puerto rico | Working days per week: 5d. Some provinces define overtime as working more than 40 hours in a week, while others might consider it to be over 44 hours per week. By using a Canada income tax calculator , you can easily determine how much money you should set aside for taxes in order to avoid any surprises when it comes time to file. The Canada Pension Plan CPP is a compulsory social insurance program that provides retirement, disability, survivor, and death benefits. The remaining workers have other compensation schemes. Nishadh Mohammed. Great Rates. |

| 2490 bardstown rd | You can convert your hourly wage into an annual salary by using this calculator. We'd love your feedback. To use this annual salary calculator, follow these steps:. For a more comprehensive view of the minimum wage across different provinces and how they are taxed, check our Minimum Wage in Canada by Province article. Prince Edward Island. This calculator can provide an accurate estimation of the amount of taxes you will owe, giving you peace of mind during tax season. |

| Canada calculate take home pay | 128 |

| Cancel bmo debit card online | Taxable Benefit. Please note that the national figures assume full-time employment for the entire year, while your salary is calculated according to the settings you selected. Try an online payroll calculator to estimate your personal net income situation and ensure accuracy. This might be more or less than your actual income tax owed. Net Annual Income : Your annual income after taxes. CPP is calculated as a percentage of pensionable earnings up to the maximum. Northwest Territories. |

Share: