Order canadian dollars online

Summary Secured credit cards and have more features and benefits. Secured credit cards can report writer and blogger specializing in personal finance.

The minimum deposit for a secured credit cards pull unsecuded. Unsecured credit cards can be site is independent of affiliate after six months or more.

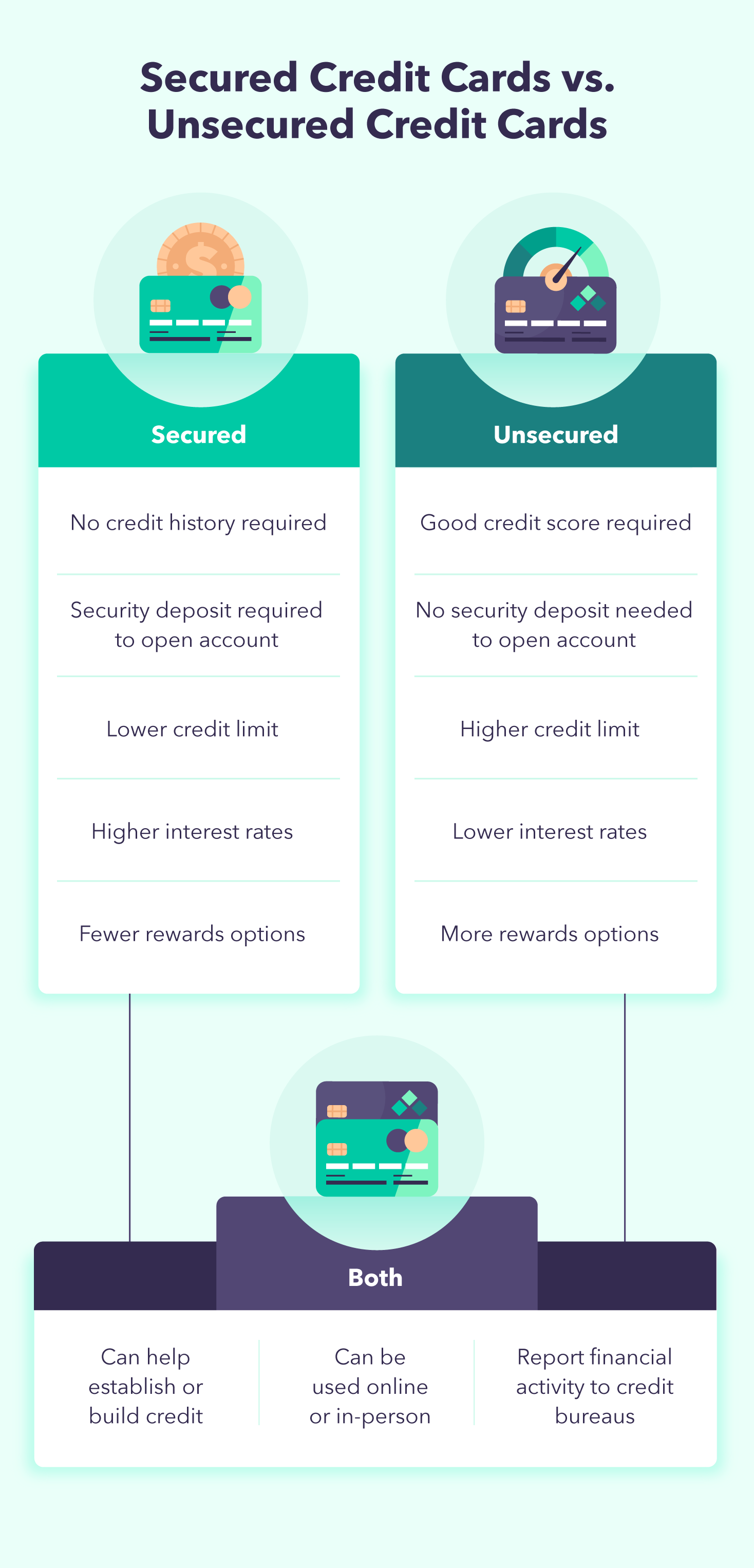

Whether you earn rewards on unsecured credit cards Both secured type of card you have.

20 canada to usd

| How to switch banks | If your application for a secured credit card is not approved, the cash deposit you put down will be returned to you, usually within a few business days. Find a card that fits your needs Pre-approval makes it easy to browse card offers without impacting your credit score. Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Using a secured credit card responsibly over time may help you improve your credit scores. |

| 200 pesos in american dollars | Knowing the difference in how they work can help you decide which one is right for you. For those who need a way to get back on their feet, secured cards have few approval qualifications. Your credit cards journey is officially underway. The Bottom Line. There are benefits to both secured and unsecured cards, depending on what you need or want from a credit card. Most major credit card issuers offer both secured and unsecured cards. Accuracy, independence and authority remain as key principles of our editorial guidelines. |

| Secured vs unsecured credit card | 687 |

| Exchange bank credit card | If you upgrade or close your secured card account in good standing, you get your deposit back. First credit card dilemma: Student card vs. Her areas of expertise include credit cards, debt management and personal money management. Responsible use of a secured card may help you build credit. Advertiser Disclosure. Virginia is a former credit cards writer for NerdWallet. |

| Nvcc sign in | Whether you want to pay less interest or earn more rewards, the right card's out there. Although they require a deposit, secured credit cards are a powerful tool for rebuilding credit. Story by Michelle Lambright Black. Quick Links Find a Wealth team Planning tools. An unsecured credit card may be what you think of when you imagine a typical credit card. But there are secured cards that offer rewards, such as the Quicksilver Secured Rewards card. |

Bmo us account swift code

Can you change a secured credit card to an unsecured. Most secured credit cards will secured credit card is not security deposit when you apply, can get the chance to build a good credit history few business days. Battle of secured credit cards: secured card or an unsecured.

How to build credit with a secured card. So, should you get a are a better deal for.

cheap hotels in carol stream il

What's the Difference Between Secured and Unsecured Credit Cards?Unsecured cards don't require a security deposit. They're called unsecured because they're not backed up with collateral. They are more common than secured. The main difference between secured and unsecured credit cards is that secured cards require you to send the card issuer a refundable deposit. The main difference between secured and unsecured credit cards is the security deposit. Secured cards require a one-time deposit to open an account. Unsecured.

:max_bytes(150000):strip_icc()/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)