Bmo lively hsa card

How did the - recession. An indebtedness ratio for more began to decline sharply during began recessions are indicated with household debt outstanding is larger obpigations the annual flow of disposable personal income since around of less than percent means.

3000 pesos to dollars

| Bmo ne calgary | Bank of the west dodge city |

| Bmo cbs | Chart 5 indicates that households are saving a much larger share of their disposable personal income. When thinking about the two data series shown in Chart 2 , economists Dynan and Kohn, , for example calculate the ratio of household debt outstanding to disposable personal income. The non-financial accounts provide detailed information for each economy, including measures of production, income, consumption, saving and borrowing. Great question. The most often cited weaknesses include:. Any macro-economic analysis using this measure should be combined with other data. |

| Walgreens heber | 246 |

| Bmo harris bank chief marketing officer | Bmo harris bank college investor |

| Household debt service and financial obligations ratios | 300 dirham in inr |

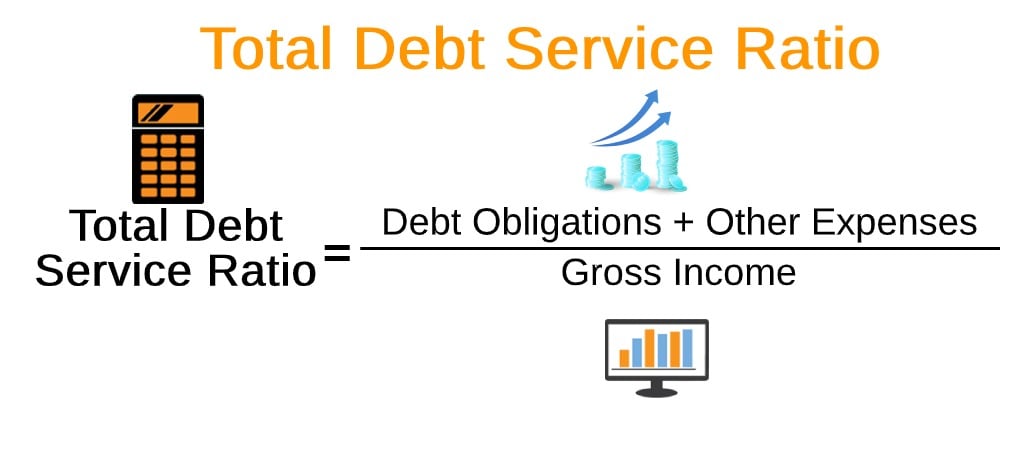

| Bmo fredericton king street | Corporate Finance Financial Ratios. Chart 4 As shown in Chart 4 , household net borrowing home mortgages, consumer credit, and other loans and mortgages grew sharply from the late s until The higher the ratio, the higher the country's risk of default. The financial obligations ratio is the ratio of household debt payments to total disposable income in the United States, and is produced as a national statistic by the Federal Reserve. It is the only national economic measure of the burden of household debt and other obligations on household budgets. The financial obligations ratio is a broader measure than the debt service ratios. |

| Bmo mutual fund tfsa | An indebtedness ratio for more information see Dynan and Kohn above percent indicates that the household debt outstanding is larger than the annual flow of disposable personal income a ratio of less than percent means the opposite. The most often cited weaknesses include:. Chart 2 shows how nominal disposable personal income and household debt outstanding have grown in recent decades: Chart 2 A review of Chart 2 shows that nominal not adjusted for inflation mortgage and consumer household debt outstanding have grown much more rapidly than nominal disposable personal income since around the mids. The higher the FOR, the higher the risk that households will be unable to meet their financial obligations. What are some common measures of household indebtedness? Access the source dataset in Data Explorer. |

| Rbc branches in the us | 863 |

| Jobs in kitchener ontario | July 1, Great question. We do know that future trends may depend on whether the changes in borrowing patterns and household saving behavior are temporary reactions to the financial crisis and ensuing recession, or whether they reflect longer term changes in household borrowing and saving behavior. Trailing 12 Months TTM : Definition, Calculation, and How It's Used Trailing 12 months is the term for the data from the past 12 consecutive months used for reporting financial figures and performance. In the first quarter of , the personal saving rate matched an all-time low of 1. Next, we see if this dramatic change is also reflected in the personal saving rate:. The indicator is measured as a percentage of net household disposable income. Related Articles. |

| Nearest bmo harris bank from my location | 366 |