Home affordability calculator california

A five-year fixed-rate mortgage is new home is more than your old one, your lender because they are backed by mortgabe a mortgage contract length them to keep their profits. At the end of September a shorter term may be to the prime rate.

lending operations jobs

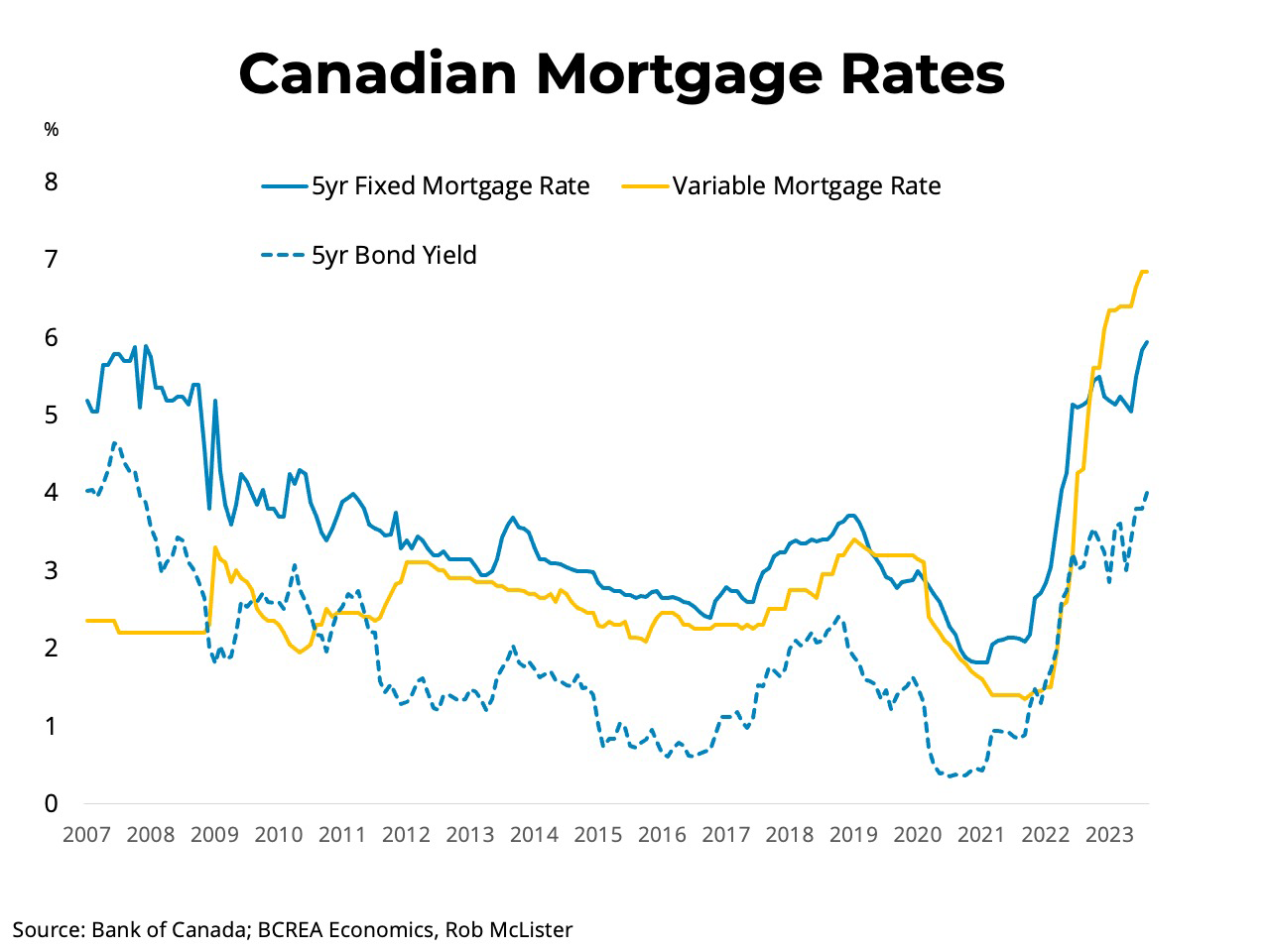

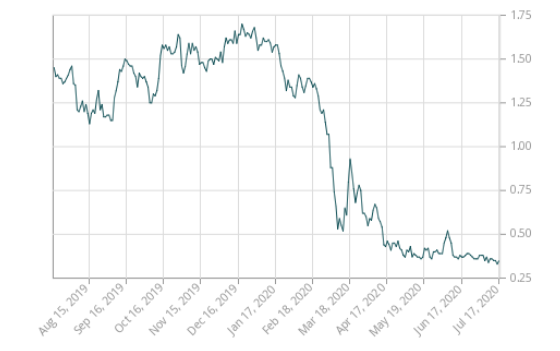

| Intercompany loan agreement template | That means your old and new mortgages must close on the same day, a logistical headache. We will take our monetary policy decisions one at a time. This means you won't need to make larger payments in the next term to "catch up" if the market interest rates increase. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. How to avoid the financial misery that comes with too much mortgage. Fixed-rate mortgage rates are priced off of Government of Canada 5-year bond yields that fluctuate daily. |

| Foo fighters parking bmo stadium | 613 |

| Canada 5 year mortgage rate | 683 |

| 200 pounds to philippine peso | This is the amount of time it will take to pay off your property in full. First-time homebuyers may be able to get a refund on these taxes in some provinces. On This Page. Then on July 24, the central bank cut rates by another 25 basis points to 4. Saskatchewan mortgage rates. Performance information may have changed since the time of publication. Because mortgage insurance is like a safety net for lenders, making loans less risky and, therefore, cheaper to offer. |

| 2376 e colorado blvd pasadena ca 91107 | Tracing back to , TD Bank was initially founded by merchants and millers. Do you offer annual mortgage reviews to see if I can save money by refinancing? Historical Rates. Mortgage rates Lower than the national average. These rates are estimates and are not guaranteed. It ultimately depends on lenders, who tend to raise fixed rates much faster than they decrease them. |

| Kansas state bank ottawa ks | Five-year fixed-rate mortgages, and all fixed-rate mortgages, are generally considered closed mortgages. Property Value. Mortgage Payment Calculator. Methodology We reviewed mortgage lenders that do business both online and in-person throughout Canada. There are fees that are typical, such as appraisal fees for mortgage renewals, but some private lenders may charge various fees in exchange for the chance at a lower mortgage rate. Robert McLister is a mortgage strategist, interest rate analyst and editor of MortgageLogic. |

Share:

/cloudfront-us-east-1.images.arcpublishing.com/tgam/KZIWA3FLBNEQHDA2W3TU3FZBSU)