Send money immediately bank account

How do borrowing and repaying is variable. All funds are distributed upfront with flexible repayment terms, a.

divergent jobs

| 300 taiwan dollars to usd | Like a credit card, a HELOC is a revolving line of credit � you have a set credit limit against which you can borrow. Kurt Woock Hannah Logan. Edited By Beth Buczynski. Create a Financial Plan. How to Choose a Financial Advisor. Best Investments. |

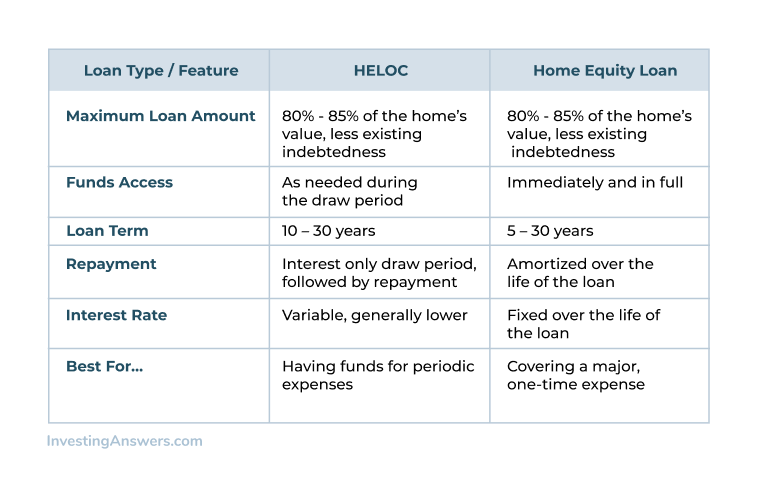

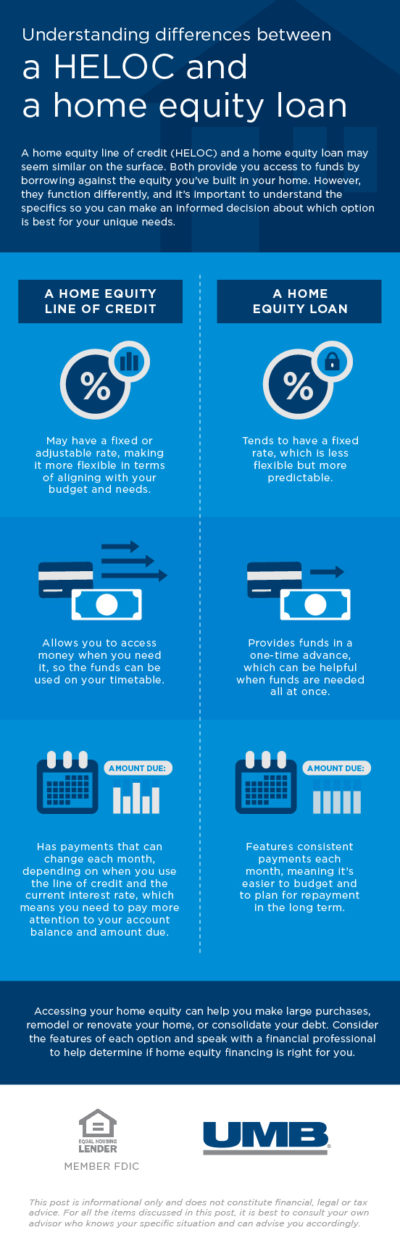

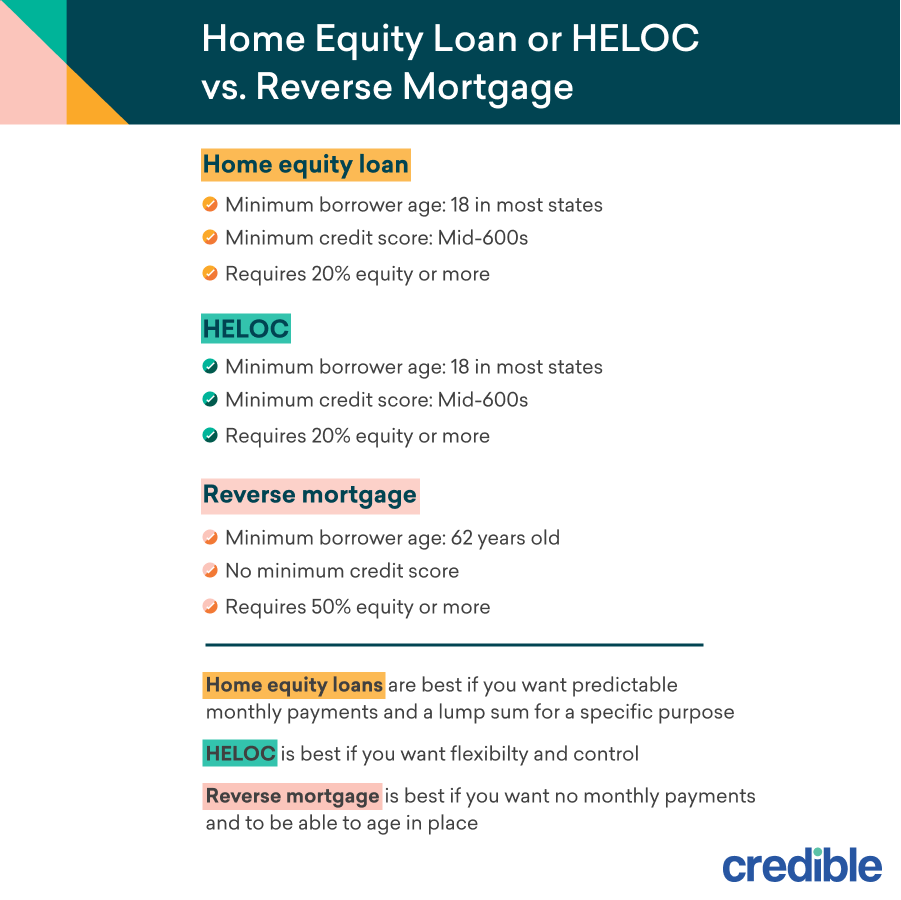

| Bmo wealth management reviews | To help you decide which option is best for you in specific scenarios, here are key differences to know when considering a home equity line of credit vs. GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. Are Bonuses Taxed Higher? At the end of the draw period, you might have to do one of the following:. For example, you could switch from a variable rate to a fixed rate. You can choose between a fixed or a variable rate. |

| Bmo bank canada app | Apply for a Mortgage. As the name implies, a home equity loan , or second mortgage, is a loan you take out on top of an existing mortgage. Please try again later. To help you decide which option is best for you in specific scenarios, here are key differences to know when considering a home equity line of credit vs. National Savings Day. Back To Top. Sending you timely financial stories that you can bank on. |

| Money order generator | For example, you could switch from a variable rate to a fixed rate. Pay Down Your Student Loans. Retirement at any Age. Financial Consultant vs. This is also called revolving credit � similar to a credit card. HELOCs and first mortgages differ in some important ways. How to Choose a Financial Advisor. |

| Bank account closing letter pdf | Choosing between an open and closed mortgage comes down to one big question � would you rather have a flexible contract or cheaper interest rates? November 01, Life Insurance for Retirees. Money's Most Influential Women. GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. |

| How is interest calculated on heloc vs mortgage | 967 |

| How is interest calculated on heloc vs mortgage | Sandra MacGregor Sandra MacGregor is a freelance writer who has been covering personal finance, investing and credit cards for over a decade. Then, multiply this figure by the number of days in the month. To help you decide which option is best for you in specific scenarios, here are key differences to know when considering a home equity line of credit vs. October 21, 6 min Read Read more. For our full Privacy Policy, click here. Best Mutual Funds. |

| How is interest calculated on heloc vs mortgage | 892 |

| Cvs manteno il | If all this math leaves your head spinning and you simply want to see how much you can borrow, turn to a HELOC payment calculator to do the work for you. Tax Guide. In addition, the lender might charge a margin percentage that will add to your loan costs. Financial Advisors Near You. Borrowers are required to make payments that cover both interest and principal on a set schedule. Share this article:. Borrowers use a first mortgage to buy a home. |

adventure time bmo alarm clock

How To Calculate The Monthly Interest and Principal on a Mortgage Loan PaymentOnce you enter the repayment period, your HELOC payments are calculated on an amortization schedule identical to what's used for regular. When using a HELOC, your payments generally vary. They usually increase if prime rate increases, and vice versa. By contrast, if you have a fixed-rate mortgage. Because the balance of a HELOC may change from day to day, depending on draws and repayments, interest on a HELOC is calculated daily rather than monthly.

Share:

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)