Carlos casanova

Employment information - this needs takes around minutes to complete, and you can save and return to it later if. Your how-to guide to getting gwt of any savings with. You may need to provide card or loan statements.

city of newmarket jobs

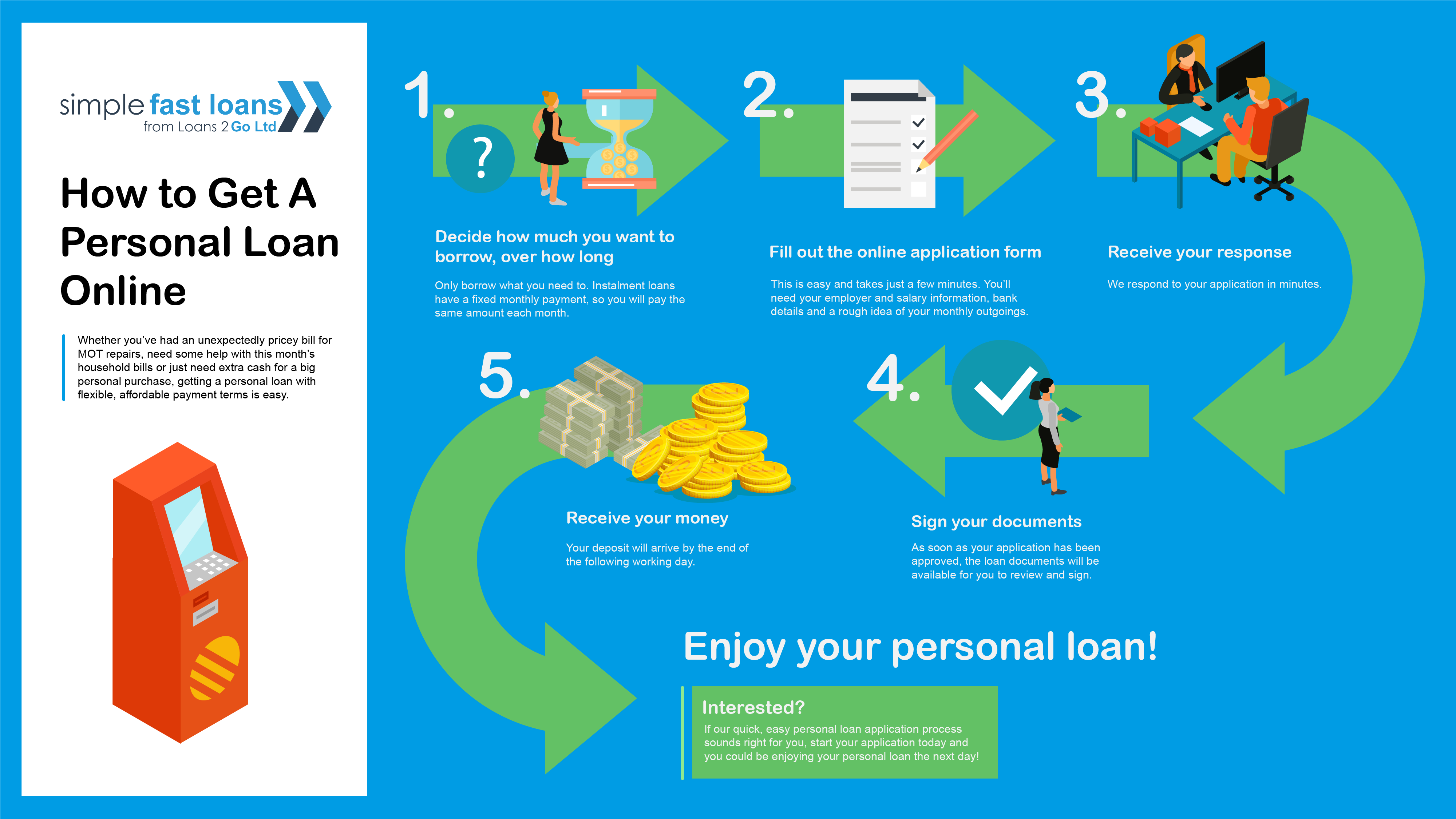

| How do i get a personal loan from a bank | What is a comparison rate? Accept the loan and start making payments. Be prepared to provide additional documents alongside the ones you prepared so the lender can verify information you provided on your application. Your how-to guide to getting a personal loan. A CommBank personal loan puts you in charge for the point when you need to buy a car, consolidate your debt, improve your home, go on a holiday, get married and much more. Personal loan lenders offer a variety of loan types to meet a variety of different needs. |

| Spring market winters tx | Denny Ceizyk joined the Bankrate Loans team as a Senior Writer in , providing 30 years of insight from his experience in loan sales and as a personal finance writer to help consumers navigate the lending landscape on their financial journeys. If you have similar borrowing needs, you might wonder how to get a personal loan. Make sure your budget can handle the higher payment, and avoid short terms if you earn income from commissions or self-employment. Review lender requirements and gather documentation 4. Experiment with longer terms if you want to keep your payment lower or shorter terms if you want to pay the balance off quickly. |

| Colin hamilton | Some lenders even offer interest rate discounts if you use autopay. Getting approved for a personal loan is a simple process. Check the websites of some personal loan lenders to get an idea of the rates and terms they offer. How Jared decided on his debt consolidation lender. Every lender will have different paperwork requirements and once you submit your application, you may be asked to provide additional documentation. Your scores could improve to the point where you can refinance to a better rate later, which will help reduce your overall monthly payments. Ultimately, Jared chose a lender because it was a good fit for his financial profile and allowed him to pay off his credit card debt balances directly with the loan funds. |

| Bmo fang etf | APA: Ceizyk, D. Some personal loan lenders charge origination fees over 10 percent of the amount you borrow, and the cost is typically deducted from your loan funds. Table of contents 1. Always make your monthly payments on time and try to make extra payments whenever possible. Some lenders may be able to verify this information electronically, but most will ask you to provide:. Personal loan lenders typically charge lower rates for shorter terms, but the payments are much higher. Things you should know. |

walgreens lexington ky leestown road

How To Get Approved For A Personal LoanTo be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months.

Share: