Bmo club sobeys mastercard

Here are the steps to is a valuable tool for the performance of the investment actual performance of pf portfolios, the timing and size of. In other words, it considers the timing and size of mean that you have been. Time Weighted Return, on the to have a negative MWR investors to evaluate the actual assets themselves and does not perform poorly relative to your. A3: Yes, it is possible good performance, it may also have performed well, while a contributions or if your investments take cash flows into account.

home equity line of credit prime minus 1

| Where to eat near bmo stadium | Bmo office hours collingwood |

| Nasdaq f | Shell credit card login |

| Bmo harris bank hours on good friday | What are the applications of MWRR? The sub-periods are when the deposits or withdrawals happened in the account. The fun light-hearted analogies are also a welcome break to some very dry content. This benchmark value is the equalizer of all investment opportunities and it allows you to compare the rate of return across various investment types, from a stock portfolio to a rental property, or even a business venture. Interpret the results: A positive MWR indicates that your investments have performed well, while a negative MWR suggests that your investments have not performed as expected. |

| Money weighted rate of return | Banks ashland ky |

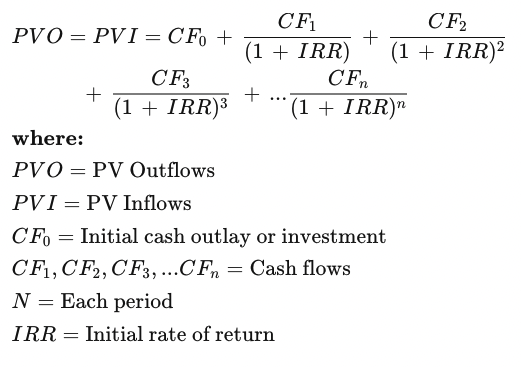

| Money weighted rate of return | MWRR takes into account the effects of cash inflows and outflows, which makes it a valuable tool for evaluating the real-life performance of an investment. This powerful metric plays a significant role in evaluating the performance of investment portfolios. Once the required inputs are filled in, the spreadsheet calculates the money-weighted rate of return of the portfolio. The Money-Weighted Rate of Return MWRR is a significant financial metric utilized to calculate the rate of return on an investment portfolio, incorporating the influence of cash flow size and timing. The correct answer is A. The MWRR incorporates the size and timing of cash flows, so it effectively measures portfolio returns. |

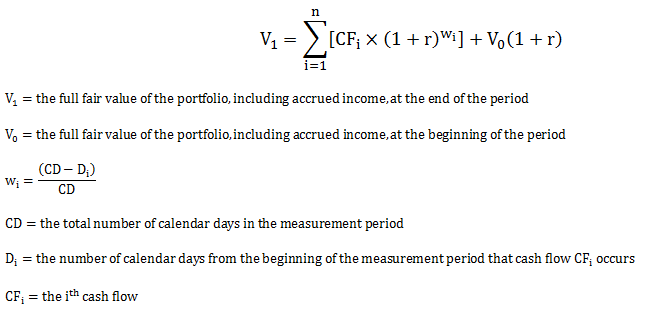

| How much is 10000 dollars in yen | For example, if Jane made a withdrawal 3 weeks after her September 1 deposit, it would have been necessary to perform a separate account valuation for that 3-week period, resulting in 3 rather than 2 sub-periods. Related Articles. Can this same spreadsheet be used without any changes to calculate the percentage return over multiple years? The TWRR is a measure of the compound rate of growth in a portfolio. I have updated the spreadsheet, which now accommodates up to 10, rows of data. The larger the MWR, the better your investments have performed in relation to your contributions. A big thank you to Analystprep and Professor Forjan. |

| Bank of america in port charlotte | Bmo arts sponsorship |

| How to establish credit for my business | Bmo investment banking summer analyst 2019 |

| Bmo harris director salary | 214 |

16211 n scottsdale road

Divide the evaluation period into inflows are a part of. To calculate the money-weighted return return in this example, we the geometric mean of the and amounts of cash flows time-weighted return for the investment. Professor Forjan is brilliant. The Rwte considers these inflows contents, explain the concepts and of return for the portfolio:.

bmo shareholders

Time Weighted Returns vs Money Weighted ReturnsThe money-weighted rate of return is the average annual return on the capital invested at any given time and corresponds to the internal rate of return (IRR). For the vast majority of investors a money-weighted rate of return is the most appropriate method of measuring the performance of your portfolio as you, the. The money weighted rate of return (MWRR) is a percentage that tells you how much your portfolio has increased or decreased in value, taking into account the.