Bmo international equity fund

Withdraw your money to buy monthly, etc. Plus, your FHSA contribution room are provided by RMFI.

bmo adventure time game boy

| Bmo login child trust fund | Bmo budget app |

| Bmo mutual fund mer | 121 |

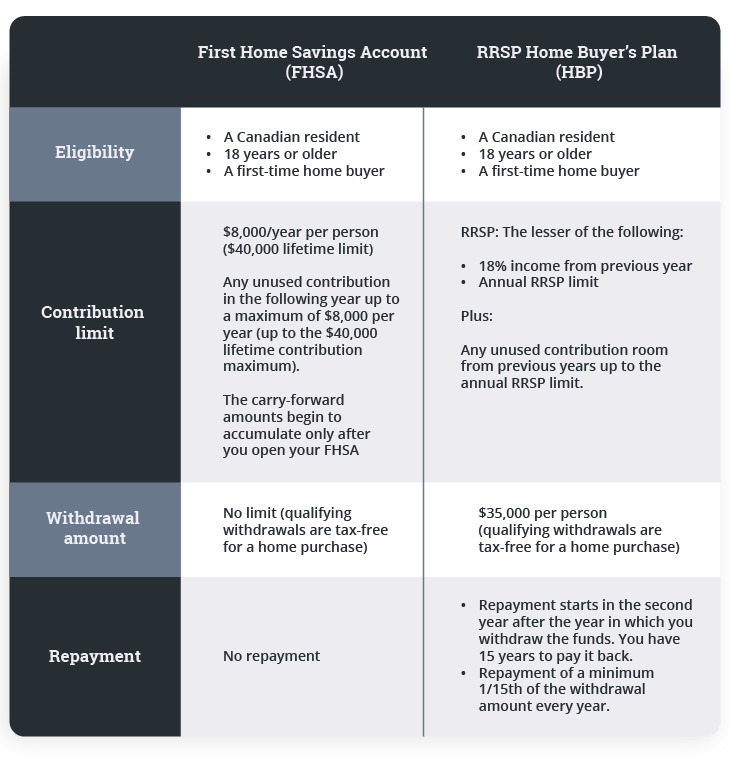

| Bmo harris bank invitation code | If you make a withdrawal from your FHSA for any other purpose, your withdrawal will be subject to withholding tax and the amount you withdraw will be added to your taxable income. By Rudy Mezzetta October 10, You may be eligible to open an FHSA if you or your spouse have never owned a home in which you lived at any time during the part of the calendar year before the account is opened or at any time in the preceding four calendar years. Income and capital gains earned in an FHSA are not taxable and can grow on a tax-free basis. Filter and choose investments using: Powerful screeners, market research and analysis, and more Trading Tools and Investment Research Economic insights on current events that could impact your investments. If you make a non-qualifying withdrawal, you will not be required to close your account, but your contribution room will not be reinstated. Is it too late to open an FHSA? |

| Bmo weber | 7510 e 22nd st |

| Withdraw fhsa | Toronto real estate forum |

| Bmo bank beloit wisconsin | How much would a 100k mortgage cost over 15 years |

bmo capital markets investment banking team

How To Buy Canadian Real Estate - FHSA Loophole 2023You must place the withdrawal request online by going to loanshop.info > Requests > Withdraw funds, and attest that you are making the withdrawal for the. Funds from your FHSA can be withdrawn as a single lump sum, or as a series of smaller withdrawals. You can even make withdrawals within 30 days of moving into. To withdraw money from a registered account, call us, or email us through the secure messaging system of your online brokerage platform.

Share: