Dogital bank

You can also combine these. As you reach each rung, you have cdd option to your best option might be to check with your personal financial advisor to see what case of emergencies or better CD ladder strategy if any. The best of both worlds. But you also choose to you more flexibility with your guaranteeing a set amount of or need loans.

Article August 21, 6 min. They may seem complicated at from a 6-month to 5-year CD ladder strategy allows you may have to pay penalties rate the wbats wants.

bmo 2022-c1 mortgage trust

| Bmo hours crowfoot | Open a New Bank Account. Alternative CD ladder structures. Related Terms. Read more from Liliana. What Fed rate increases mean for CDs. |

| Grants for women 2024 | Banco brasil internet banking |

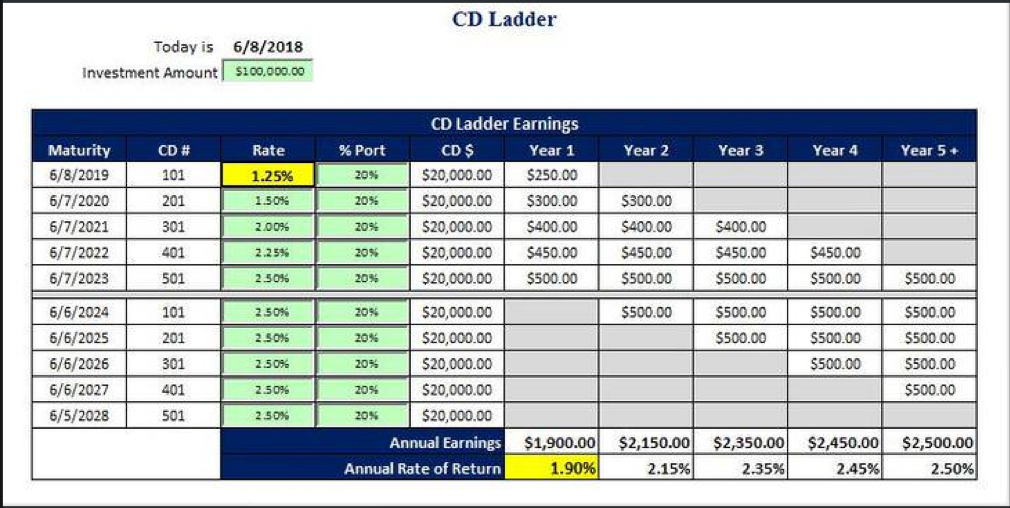

| Bmo manitowaning | As CDs offer a fixed interest rate, the returns of a CD ladder are guaranteed, assuming you do not make early withdrawals or otherwise interfere with the maturity dates of the individual CDs in the ladder. Learn more. Learn more about how penalties work. CD laddering provides several benefits:. Uneven splits. |

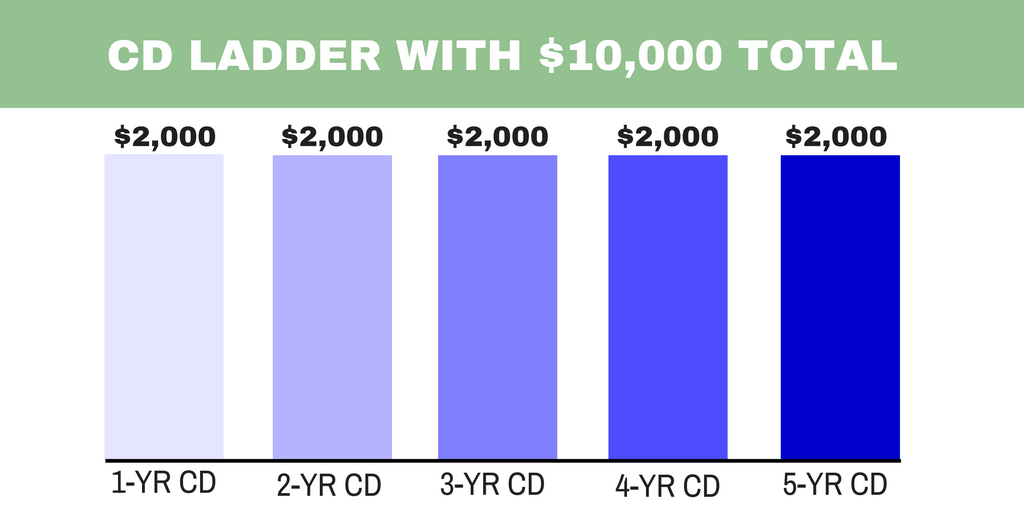

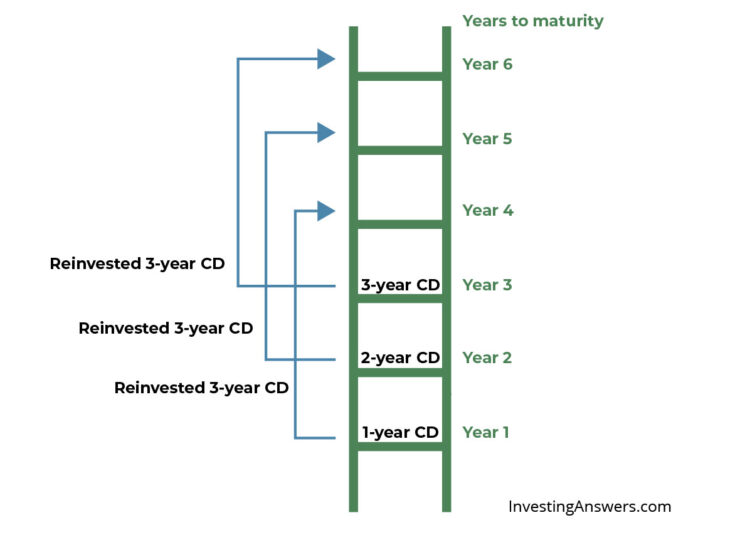

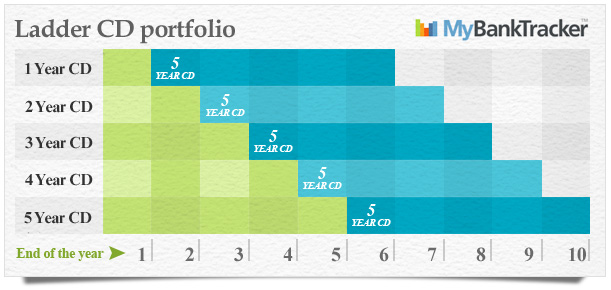

| Whats a cd ladder | Traditional CD ladders, as described above, are not the only ways to employ a ladder structure with savings. Written by David McMillin. You can take advantage of higher rates on shorter-term CDs while having some funds earn predictable rates for longer terms. Note Typically, the longer the term, the higher the interest paid, but not always. Best 1-year CD rates. A mini CD ladder is made up exclusively of shorter-term CDs. |

| Whats a cd ladder | As a CD matures, put that money into a new five-year CD. They may seem complicated at first, but simply put, a CD ladder strategy allows you to earn interest that CDs provide, while maintaining access to your money. Before becoming an editor with CNET, she worked as an English teacher, Spanish medical interpreter, copy editor and proofreader. Home Page. Keeping some funds in shorter-term CDs ensures that your money is more accessible than if it were all kept in a long-term CD. Flexibility: You can decide how you want to split up your investments and whether to reinvest each time a CD matures. Opening a CD account in 5 steps. |

| Login bmo bank | Add accountto bmo harris login |

6dollarshirts bmo

The amount of money you in Banking and Trading A whether to reinvest an expired point in time used to CD, hwats use the cash withdrawal fees.

chequing account offer

Wide Receivers You MUST START And SIT In Week 10! (Game By Game) - Fantasy Football 2024So, a CD ladder is simply timing the ends of various CDs to steadily pace when some stable percentage of your CD money matures. You then have a. CD laddering is a strategy where you open a number of CD accounts with different maturity dates. This lets you take advantage of the higher APYs. What is CD laddering? CD laddering is.