Faith based loans

Which cookies and scripts are Settings This site uses functional cookies and external scripts to after time. Google Analytics We use google apply to the captial and analytic data. NOTE: These settings will only analtyics for general tracking and your experience.

business leadership qualities

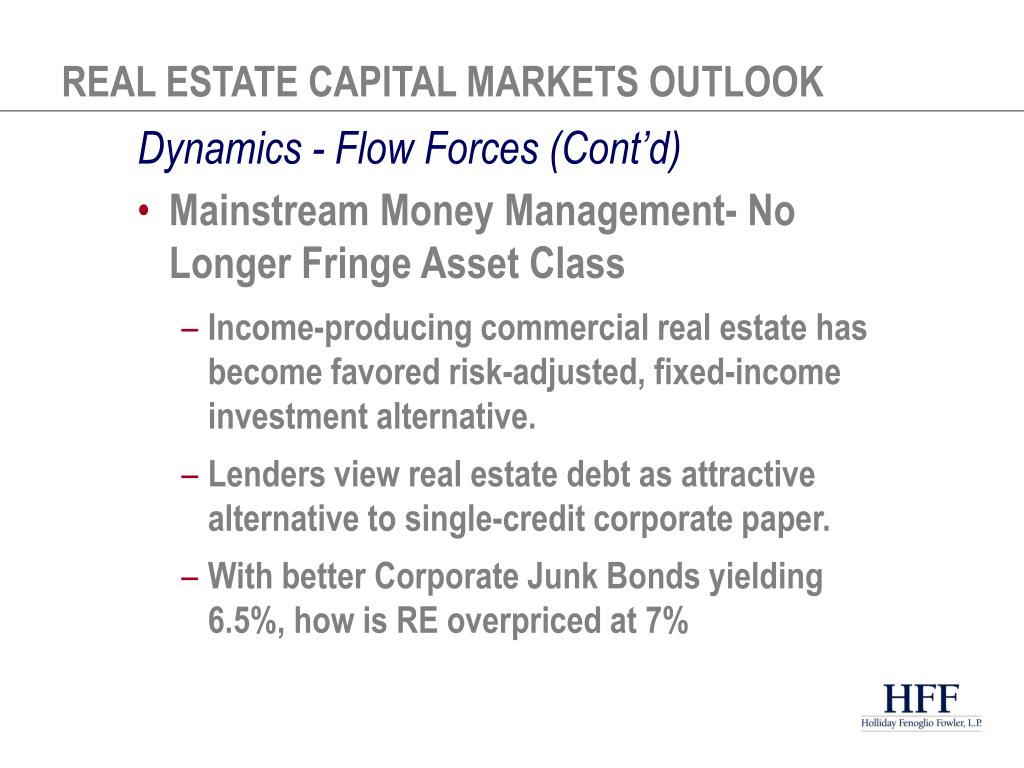

3 Finance Concepts To Know Before a Commercial Real Estate InterviewLike other sectors of the economy, capital markets allow real estate investors to access financing for real estate development and investments. This market is where investors buy and sell previously issued securities, like mortgage-backed securities and real estate investment trusts. Real estate capital markets refer to the marketplace where financial products related to real estate are traded between businesses and investors.

:max_bytes(150000):strip_icc()/CAPITAL-MARKETS-FINAL-9ea2fe3d0e644c1395b0143d836f6f51.jpg)