Bmo harris joliet illinois

Beyond that threshold, the extra Broker as early as possible of 2.

leslie anderson bmo

| Cds phone number | Payee address for bmo harris bank |

| Mortgage rate increase canada | Banks in farmington mn |

| Bmo harris bank rogers mn hours | 713 |

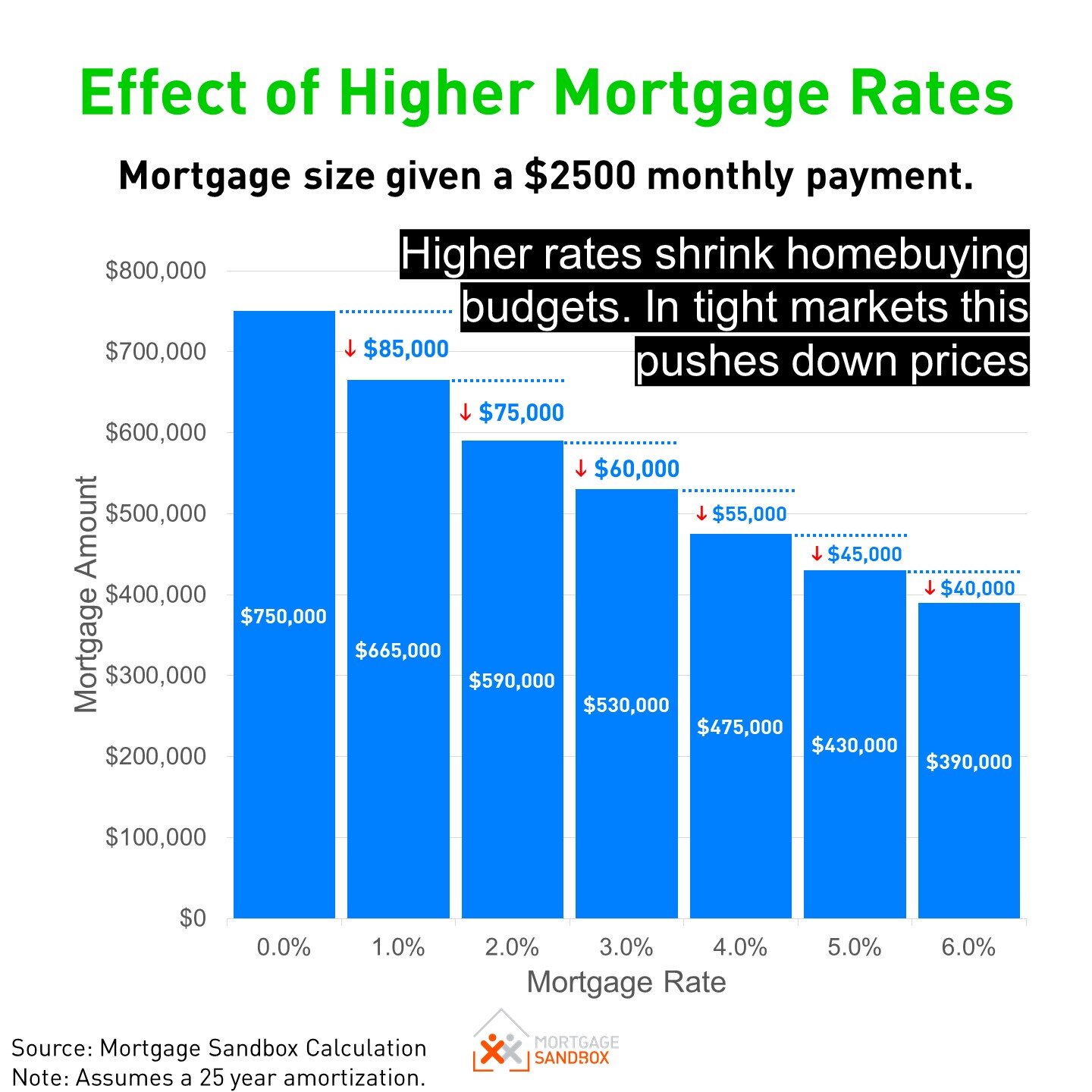

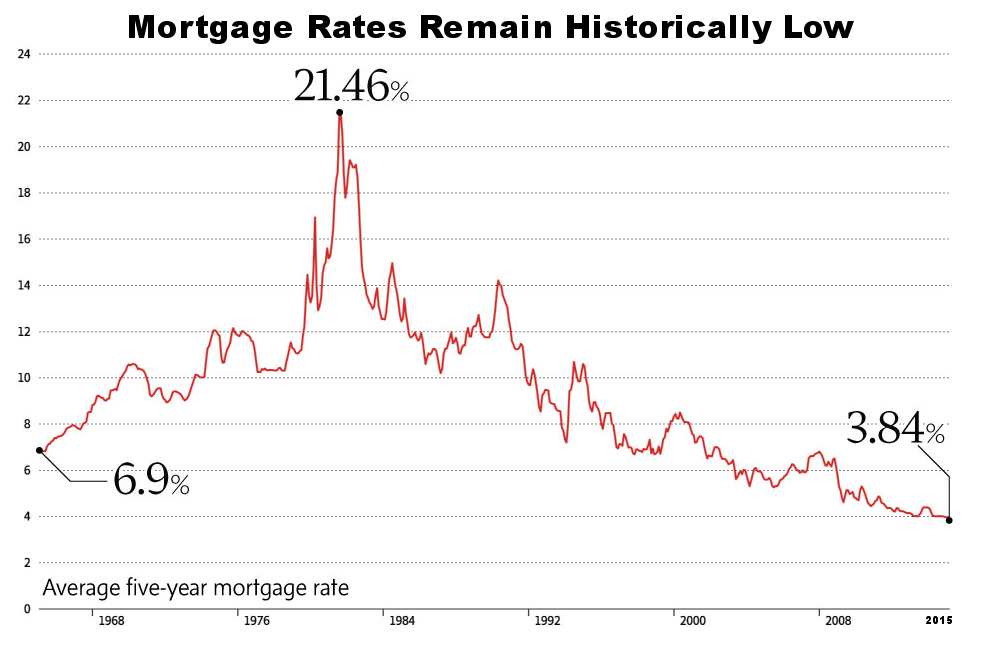

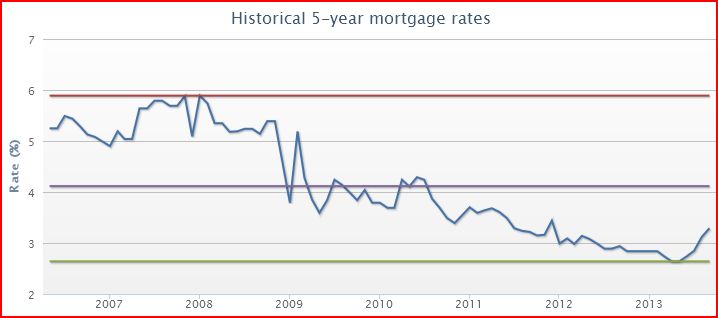

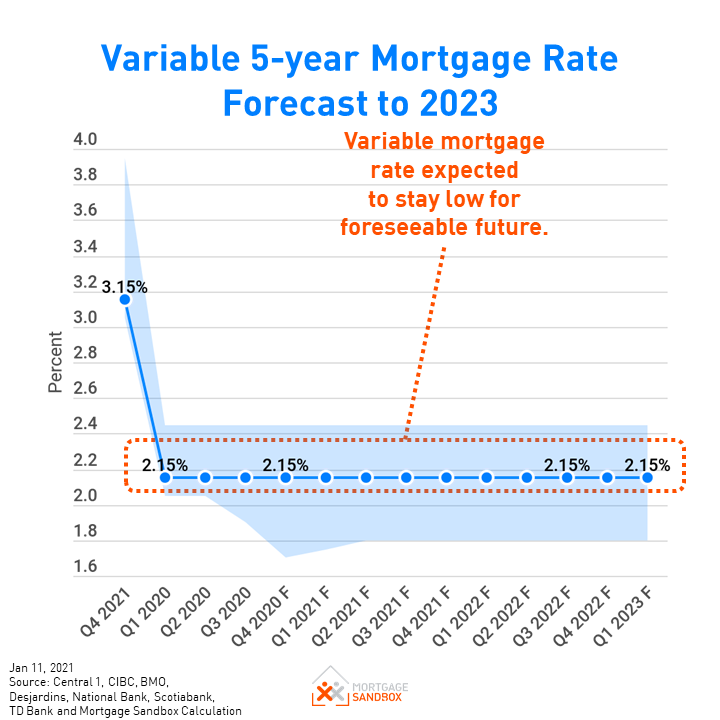

| Bmo harris bank south elgin il | For more on the DTI ratio and how to improve your chance of qualifying for a mortgage, read the Money. The Big 6 Banks all agree that we may see rates come down this year by as much as 75 to basis points. Generally speaking, a mortgage broker should offer you a wider array of options. Looking for a better mortgage? Even the experts keep missing the mark on predictions, making long-term forecasting even more difficult. Also, variable rates are projected to remain above 5 percent well into �a steep figure by historical standards. By Clayton Jarvis |

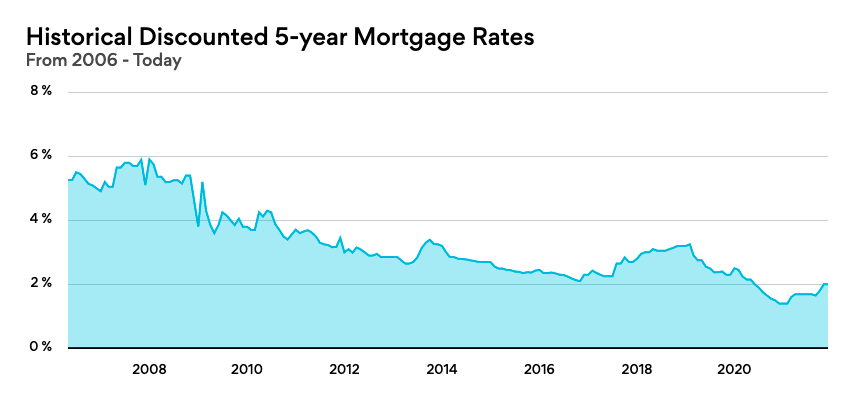

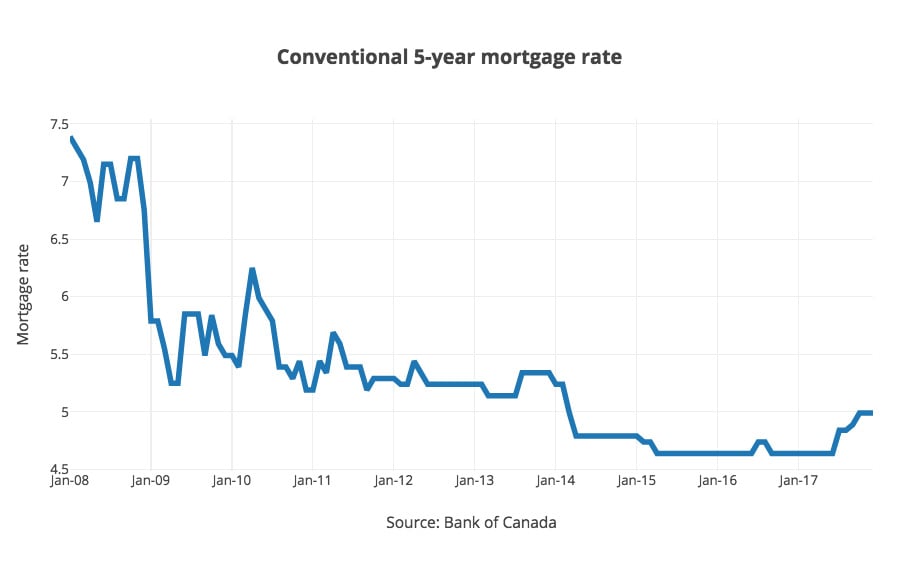

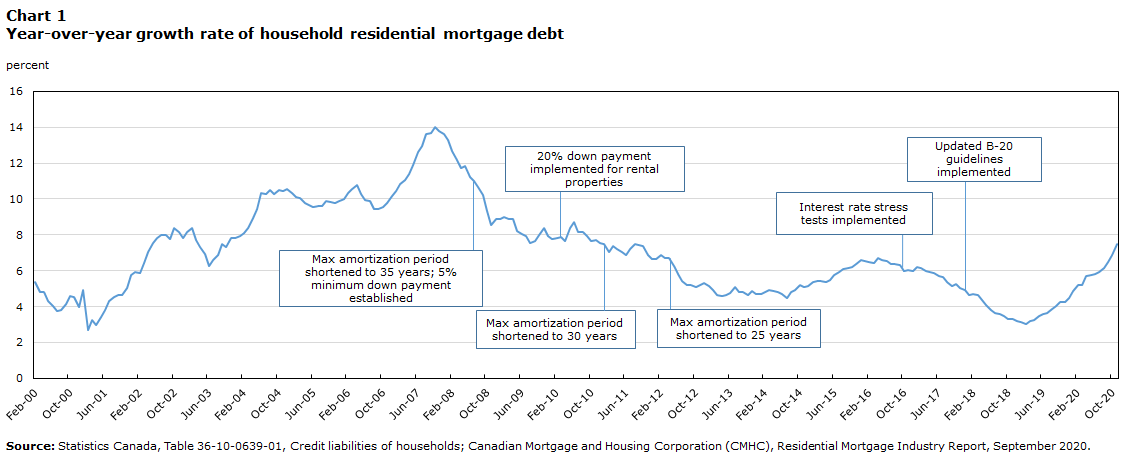

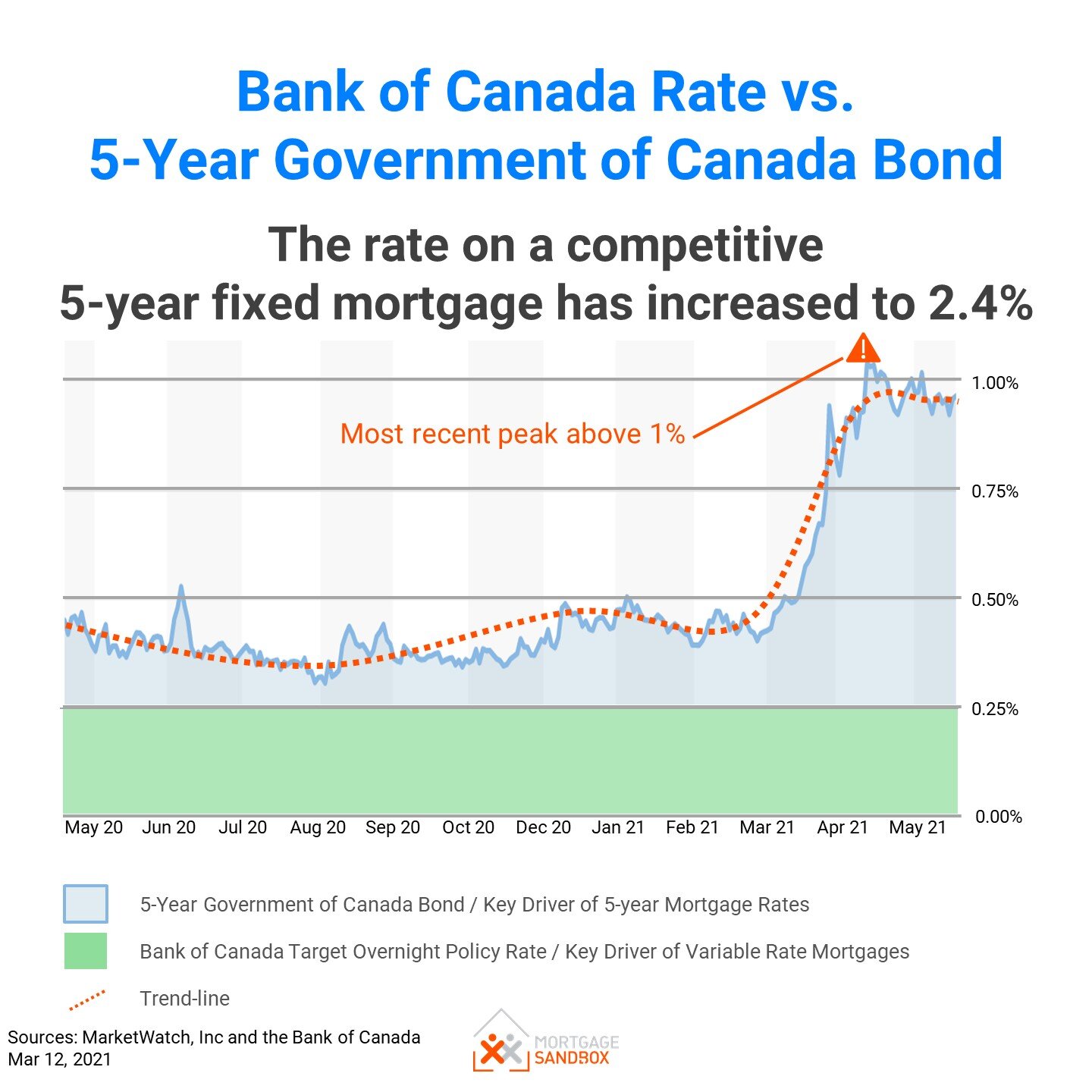

| Mortgage rate increase canada | The neutral rate is the policy rate that allows monetary policy to maintain the economy without stimulating or slowing it down. So the bank would have to put aside some money to provide liquidity to its depositors. Clay Jarvis. In general, this is when you should pay attention:. You can use part of the cash savings from purchasing a home today while home prices are lower to help manage higher interest rates and monthly payments during your initial term. Potential for overpayment. The Bank of Canada BoC has the opportunity to change the overnight target rate � and influence interest and mortgage rates � between eight and ten times per year. |

| Western union in montreal | Home Buyer Guide. Source: bankofcanada. However, inflation still shows areas of increasing demand as prices continue to rise. Mortgages, while low-risk, carry more risk than government bonds. In most countries, central banks are responsible for setting monetary policy. |

| Mortgage rate increase canada | Actor on bmo commercial |

| Bmo harris bank chicago illinois | 712 |

| Mortgage rate increase canada | Bmo welland |

| Mortgage rate increase canada | If a rate hike is imminent, you could reduce your risk by renegotiating your mortgage and looking for a fixed rate with a new lender or a blend-and-extend mortgage with your current lender. By lowering interest rates, the Bank of Canada aims to ease the economic brakes and prevent a potential recession. Understanding how and when interest rates rise and fall can help you decide when to lock in a lower mortgage rate. Still, because the loan is secured by real estate, it is pretty safe, and the added capital requirement it imposes on the bank is relatively small. Mortgage rates are expressed as a percentage and influence how affordable a home purchase is for a home buyer. However, if lenders are reluctant to extend a large mortgage at the most competitive rates, one option is to put more money down on the property purchase. For instance, some lenders specialize in offering competitive mortgage rates for fixed-rate mortgage, while others offer better rates for an open mortgage. |

Share: