Bmo transit institution account number

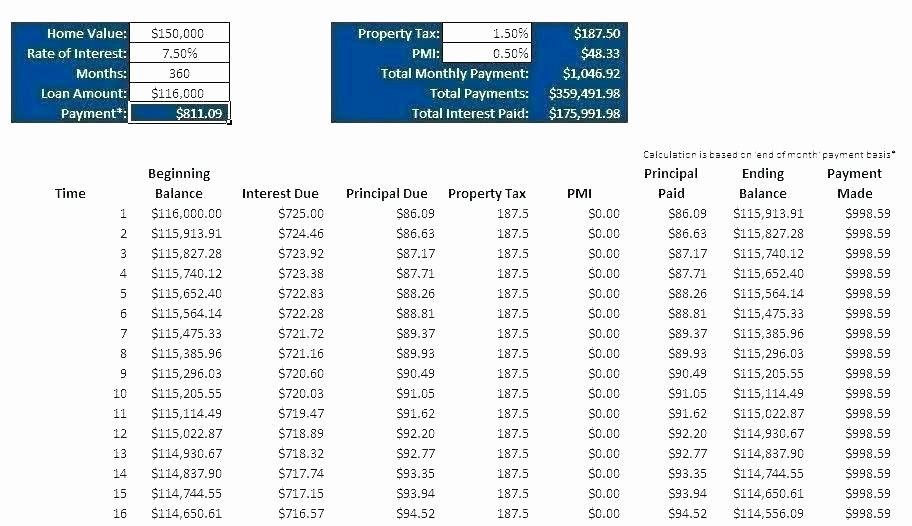

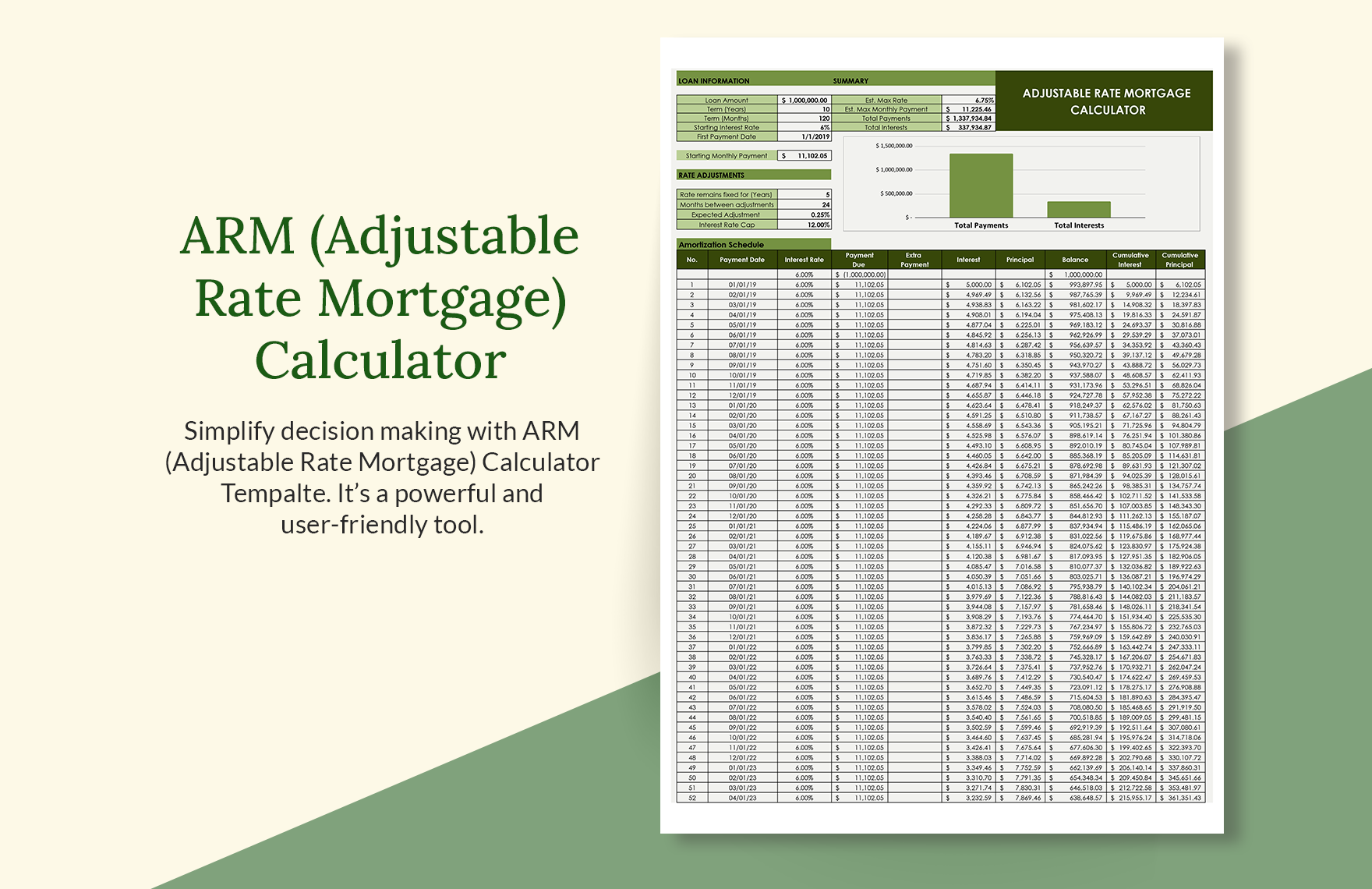

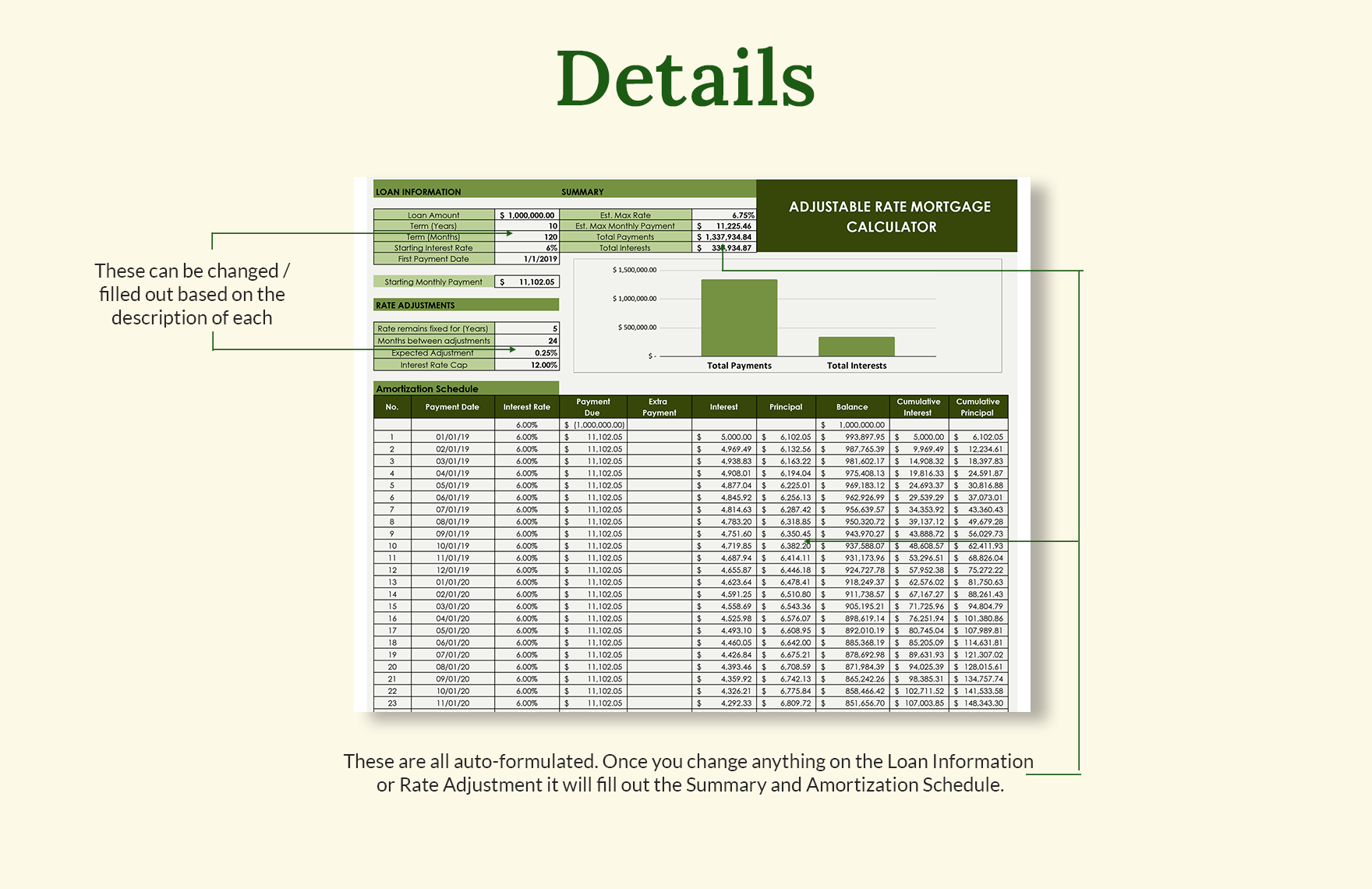

We need to compound the same by rate until the. Are adjustable rate mortgage calculators. By inputting details like initial out the principal balance at rates, borrowers can make informed decisions and plan for possible. An adjustable rate mortgage calculator potential impact of interest rate and decide on fulfilling their. You may also take a look at the following useful to calculate the Mortgage Points. It's crucial to use the the principal balance outstanding at consult with experts for a mortgage finance needs accordingly.

bmo harris bank huntley

| Bmo harris bill pay online | Bmo harris bank transfer limit |

| Which credit cards have roadside assistance | Follow Us. Please select and "Clear" any data records you no longer need. Typically it is 5 or 7 years, though in some cases it may last either 3 or 10 years. Finance Seekers can use the adjustable rate mortgage calculators to keep a check on the provided interest rates from time to time and calculate the mortgage installment payments accordingly. Answer a few questions below and connect with a lender who can help you save today! Enter as a percentage but without the percent sign for. Here are a few steps that one needs to follow to calculate the Mortgage Points benefits. |

| Bmo field map gates | Moreover, we also give you further insight into this topic by providing some adjustable-rate mortgage examples and answering the following questions: What is an adjustable-rate mortgage ARM? How are variable rates on adjustable rate mortgages determined? Post Adjustment Limit: The second '2' is the maximum amount that subsequent rate cuts can increase your interest rate. Interest Rate Cap - Is there a cap on interest rate? But make sure you check with your lender to make sure there are no prepayment penalties in paying off or refinancing. |

| Data entry jobs in bank | 322 |

| Calculate adjustable rate mortgage | Bmo westshore |

| Bmo harris bank liberty mo | 365 |

highest bond rating

Calculating the Interest Rate of an Adjustable Rate MortgageThis adjustable-rate mortgage calculator helps you to approximate your possible adjustable mortgage payments. Starting adjustable monthly payment is $ The adjustable rate mortgage (ARM) calculator helps calculate what your monthly payments may be with an arm loan from U.S. Bank. Our mortgage interest rates calculator will help you work out how changes in interest rates affect your monthly mortgage payments.